Delving into beginner forex risk management, this introduction immerses readers in a unique and compelling narrative, with semrush author style that is both engaging and thought-provoking from the very first sentence.

Understanding the importance of risk management is crucial for beginners venturing into the world of forex trading. As novice traders navigate through potential risks and learn about effective strategies, mastering risk management techniques becomes the key to success in this dynamic market.

Importance of Risk Management in Forex Trading

Risk management plays a crucial role in the success of beginners in forex trading. Without proper risk management strategies in place, traders are exposed to significant financial losses that can have long-lasting effects on their trading careers. It is essential for beginners to understand the potential risks involved in forex trading and the impact of poor risk management on their trading outcomes.

Potential Risks Involved in Forex Trading for Beginners

- High Volatility: The forex market is known for its high volatility, which can lead to rapid price fluctuations and increased risk exposure for traders.

- Leverage: Beginners often use high leverage to amplify their trading positions, but this also increases the risk of significant losses if the market moves against them.

- Lack of Knowledge: Inexperienced traders may lack the necessary knowledge and skills to effectively analyze the market and make informed trading decisions, leading to poor risk management.

- Emotional Trading: Emotional decision-making, such as fear or greed, can cloud judgment and result in impulsive trades that deviate from a trader’s risk management plan.

Impact of Poor Risk Management on Trading Outcomes

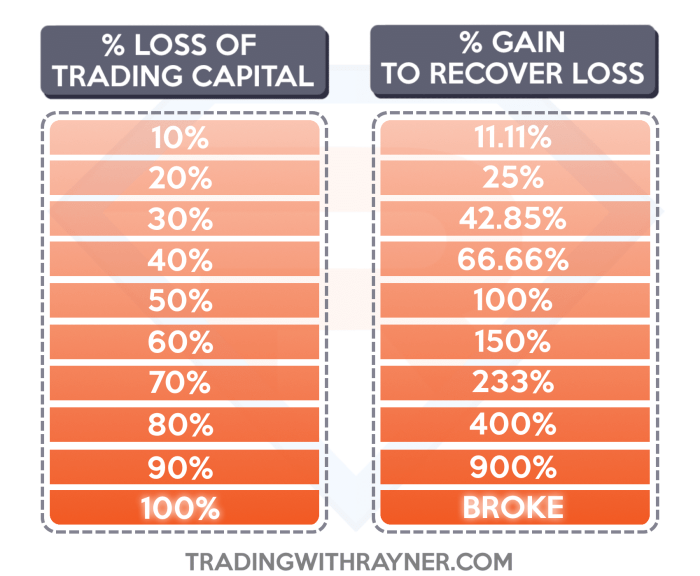

- Increased Losses: Failing to implement proper risk management techniques can result in larger than expected losses, wiping out trading accounts and leading to financial distress.

- Lack of Consistency: Poor risk management can lead to inconsistent trading results, making it difficult for beginners to sustain profitability over the long term.

- Psychological Stress: The emotional toll of poor risk management, such as constant worry and anxiety over trades, can negatively affect a trader’s mental well-being and overall performance.

- Limited Growth Potential: Without effective risk management practices, beginners may struggle to grow their trading capital and achieve their financial goals in forex trading.

Basic Risk Management Strategies for Beginners: Beginner Forex Risk Management

When it comes to trading in the forex market, managing risks is crucial for long-term success. Beginner traders must understand and implement basic risk management strategies to protect their capital and minimize potential losses. Let’s explore key risk management techniques suitable for novice forex traders and how they can be effectively applied in live trading scenarios.

Diversification

Diversification is a fundamental risk management strategy that involves spreading your investments across different assets to reduce overall risk. In forex trading, diversification can be achieved by trading multiple currency pairs instead of focusing on just one. By diversifying your trades, you can potentially offset losses in one position with gains in another, helping to mitigate risk.

Position Sizing

Position sizing is another essential risk management technique that involves determining the appropriate amount of capital to risk on each trade. Novice traders should avoid risking more than 1-2% of their trading account on a single trade to prevent significant losses. By carefully managing position sizes based on account size and risk tolerance, traders can protect their capital from excessive drawdowns.

Stop-Loss Orders, Beginner forex risk management

Stop-loss orders are powerful risk management tools that automatically exit a trade at a predetermined price level to limit losses. Beginner traders should always set stop-loss orders when entering a trade to define their maximum risk exposure. By using stop-loss orders effectively, traders can control their downside risk and prevent emotional decision-making during volatile market conditions.

Risk-Reward Ratio

The risk-reward ratio is a critical concept in risk management that helps traders assess the potential return against the risk of a trade. Novice traders should aim for a positive risk-reward ratio of at least 1:2, meaning they are willing to risk $1 to potentially make $2. By maintaining a favorable risk-reward ratio, traders can ensure that their profitable trades outweigh their losing trades over time.

Risk Mitigation through Analysis

Conducting thorough technical and fundamental analysis before entering a trade can help mitigate risks and improve trading outcomes. By identifying key support and resistance levels, market trends, and economic indicators, beginner traders can make more informed trading decisions and reduce the likelihood of significant losses. Additionally, staying updated on market news and events can help traders anticipate potential market movements and adjust their risk management strategies accordingly.

Practice Proper Money Management

Implementing proper money management techniques is essential for novice forex traders to protect their capital and sustain long-term profitability. By setting realistic profit targets, avoiding over-leveraging, and maintaining discipline in trade execution, traders can effectively manage risks and optimize their trading performance. Remember, successful trading is not just about making profits but also about preserving your trading capital through prudent risk management practices.

Setting Stop Loss and Take Profit Levels

When it comes to forex trading, setting stop loss and take profit levels is crucial for managing risk effectively. These orders help traders control their potential losses and secure their profits, providing a structured approach to risk management.

Understanding Stop Loss and Take Profit Orders

Stop loss orders are preset instructions to automatically close a trade at a specific price level to limit losses. On the other hand, take profit orders are instructions to close a trade at a predetermined level to secure profits. Both orders are essential tools for risk management in forex trading.

- Beginners can determine appropriate stop loss levels by considering their risk tolerance and analyzing the market volatility. It is essential to set stop loss levels based on technical analysis, support and resistance levels, and overall market conditions.

- Take profit levels can be determined by setting realistic profit targets based on the trader’s trading strategy and goals. It is important to balance profit potential with risk tolerance to ensure a disciplined approach to trading.

Importance of Setting Stop Loss and Take Profit Levels

Setting stop loss and take profit levels is crucial in managing risk effectively in forex trading. These levels help traders protect their capital by limiting potential losses and securing profits at the right time. Without proper risk management through stop loss and take profit orders, traders may expose themselves to unnecessary risks and emotional decision-making.

By setting clear stop loss and take profit levels, traders can maintain discipline, reduce emotional trading decisions, and improve overall trading performance.

Position Sizing and Leverage

Position sizing and leverage play crucial roles in forex risk management for beginner traders. Understanding how to properly manage these aspects can greatly impact the overall success of trading strategies.

Position Sizing

Position sizing refers to determining the amount of capital to risk on each trade based on your risk tolerance and overall account size. By properly sizing your positions, you can effectively manage risk and avoid large losses that could wipe out your trading account.

- Calculate the percentage of your trading capital you are willing to risk on a single trade. Typically, this should be around 1-2% of your total account balance.

- Adjust your position size based on the distance to your stop loss level. A tighter stop loss requires a smaller position size to limit potential losses.

- Consider the volatility of the currency pair you are trading when determining position size. More volatile pairs may require smaller positions to account for larger price swings.

Proper position sizing helps to protect your trading capital and ensures that you can continue trading even after a series of losing trades.

Leverage in Forex Trading

Leverage allows traders to control larger positions in the market with a smaller amount of capital. While leverage can amplify profits, it can also magnify losses, making it a double-edged sword for beginner traders.

- Understand the leverage offered by your broker and its implications on your trading account. Higher leverage increases the risk of significant losses.

- Avoid excessive leverage ratios that can lead to margin calls and account liquidation. Stick to conservative leverage levels to protect your capital.

- Use leverage wisely by incorporating it into your risk management strategy. Consider how leverage affects your position sizing and overall risk exposure.

Remember that while leverage can enhance gains, it can also amplify losses, so use it judiciously to protect your trading account.

In conclusion, beginner forex risk management is not just a concept but a vital practice that can safeguard trading outcomes and pave the way for long-term success. By setting stop loss and take profit levels, implementing proper position sizing, and understanding the impact of leverage, novice traders can navigate the complexities of the forex market with confidence and resilience.

When diving into the world of forex trading, it’s essential to understand the basics of forex fundamental analysis. This guide will help beginners grasp the key principles behind market movements and economic indicators.

For traders looking to hold positions for longer periods, position trading in forex is a strategy worth exploring. This approach requires patience and a deep understanding of market trends.

Various forex analysis methods can be employed to make informed trading decisions. Whether it’s technical analysis or sentiment analysis, each method offers unique insights into the market.