Best forex trading platforms are essential for traders looking to optimize their trading experience. In this comprehensive guide, we explore the key features, pros and cons, and customization options of the top platforms in the market.

Overview of Forex Trading Platforms: Best Forex Trading Platforms

In the world of forex trading, having access to the best trading platforms is crucial for traders looking to execute trades efficiently and effectively. These platforms provide the necessary tools and features to analyze markets, place trades, and manage positions in real-time.

Key Features to Look for in a Trading Platform

When choosing a forex trading platform, there are several key features to consider that can enhance your trading experience:

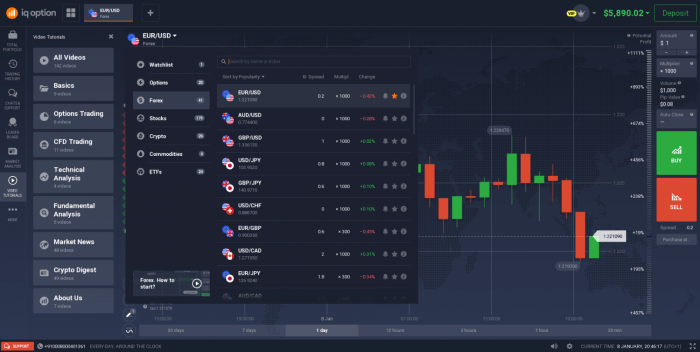

- Intuitive Interface: A user-friendly interface that is easy to navigate and customize can improve efficiency and reduce the learning curve for new traders.

- Advanced Charting Tools: Robust charting capabilities with technical analysis tools can help traders make informed decisions based on price movements and patterns.

- Order Types: The ability to place various order types, such as market orders, limit orders, and stop orders, can help traders implement their strategies effectively.

- Real-time Data and News: Access to real-time market data and news updates can provide valuable insights into market trends and events that may impact currency prices.

- Risk Management Tools: Features like stop-loss orders and risk management tools can help traders mitigate potential losses and protect their capital.

How Trading Platforms Facilitate Trading Activities, Best forex trading platforms

Forex trading platforms play a vital role in facilitating trading activities by providing traders with the tools and resources needed to monitor the markets, analyze price movements, and execute trades. These platforms enable traders to access a wide range of currency pairs, leverage trading opportunities, and manage their positions effectively. With features like real-time data, advanced charting tools, and order management capabilities, trading platforms empower traders to make informed decisions and participate in the global forex market with confidence.

Popular Forex Trading Platforms

When it comes to choosing a forex trading platform, there are several options available in the market. Each platform offers a unique set of features, fees, and user interface that cater to the needs of different traders. In this section, we will list and describe some of the best forex trading platforms, compare their features, fees, and user interface, and discuss the pros and cons of each platform.

MetaTrader 4 (MT4)

MetaTrader 4, also known as MT4, is one of the most popular forex trading platforms in the industry. It offers a user-friendly interface, advanced charting tools, and a wide range of technical indicators for analysis. MT4 also allows for automated trading through Expert Advisors (EAs). While it is widely used and supported by many brokers, some traders may find its interface outdated compared to newer platforms.

MetaTrader 5 (MT5)

MetaTrader 5, the successor to MT4, is another popular choice among forex traders. It offers all the features of MT4 and more, including additional timeframes, more technical indicators, and an economic calendar. MT5 also supports a wider range of asset classes beyond forex, such as stocks and commodities. However, some traders may find it more complex to navigate compared to MT4.

cTrader

cTrader is a forex trading platform known for its user-friendly interface and advanced charting capabilities. It offers a clean and intuitive layout, making it easy for traders to place trades and analyze the markets. cTrader also provides access to a community of traders where users can share strategies and ideas. On the downside, cTrader may have higher fees compared to other platforms.

NinjaTrader

NinjaTrader is a popular platform among active traders and institutional clients. It offers advanced charting tools, backtesting capabilities, and a wide range of order types for executing trades. NinjaTrader also supports automated trading through its NinjaScript feature. However, some traders may find NinjaTrader’s interface overwhelming and less user-friendly compared to other platforms.

cTrader

cTrader is a forex trading platform known for its user-friendly interface and advanced charting capabilities. It offers a clean and intuitive layout, making it easy for traders to place trades and analyze the markets. cTrader also provides access to a community of traders where users can share strategies and ideas. On the downside, cTrader may have higher fees compared to other platforms.

TradingView

TradingView is a web-based platform that offers advanced charting tools, social networking features, and a wide range of technical analysis tools. It allows traders to share ideas, charts, and strategies with other users in real-time. TradingView is popular among forex traders for its easy-to-use interface and extensive library of indicators. However, some traders may find its pricing plans expensive compared to other platforms.

Customization and User Experience

When it comes to forex trading platforms, customization and user experience play a crucial role in enhancing the overall trading efficiency for users. The ability to personalize the platform according to individual preferences can significantly impact how traders interact with the system and make informed decisions.

Significance of Customization Options

Customization options on forex trading platforms are essential as they allow users to tailor the platform to suit their trading style, preferences, and needs. This not only enhances the user experience but also improves efficiency by providing a more intuitive and personalized trading environment. Some of the key benefits of customization options include:

- Personalizing chart layouts and color schemes for better visualization of market data.

- Setting up custom alerts and notifications to stay informed about market movements.

- Creating watchlists of preferred assets for quick access to relevant information.

- Adjusting risk management settings to align with individual trading strategies.

Examples of Personalization in Trading Experience

Users can personalize their trading experience on forex platforms in various ways, such as:

- Choosing preferred trading instruments and asset classes to focus on.

- Customizing indicators and technical analysis tools for better decision-making.

- Setting up automated trading strategies or algorithms based on personal preferences.

- Adjusting leverage and margin requirements according to risk tolerance levels.

Impact of User Experience on Trading Efficiency

A seamless user experience on forex trading platforms can significantly impact trading efficiency by:

- Improving speed and accuracy in executing trades.

- Enhancing decision-making through intuitive interface design and customization options.

- Reducing errors and minimizing the risk of costly mistakes.

- Increasing overall satisfaction and engagement, leading to better trading performance.

Security and Regulation

When it comes to forex trading platforms, security and regulation are crucial aspects that traders need to consider. Ensuring the safety of funds and personal information is paramount in the world of online trading.

Importance of Security Measures

Forex trading platforms must implement robust security measures to protect the funds and sensitive data of their users. Encryption protocols, two-factor authentication, and secure payment gateways are some of the key features that ensure a secure trading environment.

Regulatory Bodies in Forex Trading

- The Commodity Futures Trading Commission (CFTC) in the United States oversees forex trading platforms operating in the country.

- The Financial Conduct Authority (FCA) regulates forex brokers in the United Kingdom, ensuring they adhere to strict guidelines.

- The Australian Securities and Investments Commission (ASIC) is the regulatory body for forex trading platforms in Australia.

Verifying Security and Legitimacy

Traders can verify the security and legitimacy of a trading platform by checking if it is regulated by a reputable authority. They should also look for SSL encryption on the platform, transparent terms and conditions, and a strong track record of customer satisfaction and trustworthiness.

In conclusion, choosing the best forex trading platform can significantly impact your trading success. By prioritizing security, customization, and user experience, traders can make informed decisions to enhance their trading efficiency.

When diving into the world of forex trading, it’s essential to understand the importance of fundamental analysis for forex trading. This method involves evaluating various economic indicators to predict currency movements accurately.

One key aspect that traders must grasp is understanding leverage in forex. Leverage allows traders to control a larger position with a small amount of capital, amplifying both profits and losses.

For those looking to ride the trends in forex markets, trend following strategies forex can be highly effective. These strategies involve identifying and following the direction of established trends to maximize profits.