Best trading apps for forex take the spotlight in this comprehensive guide, diving into the top 5 apps that are revolutionizing the way traders engage with the market. Get ready to explore the key features, user interface, and more as we unravel the world of forex trading apps.

Best Trading Apps for Forex

When it comes to forex trading, having the right app can make all the difference. Here are the top 5 trading apps for forex that offer a range of features to help you make informed decisions and trade effectively.

MetaTrader 4

MetaTrader 4 is a popular trading app known for its comprehensive charting tools, technical analysis capabilities, and a wide range of indicators. It offers real-time quotes, customizable charts, and the ability to automate trading strategies through Expert Advisors. The user-friendly interface and intuitive design make it a favorite among traders looking for a reliable platform.

TradingView, Best trading apps for forex

TradingView is another top-rated trading app that provides advanced charting tools, social networking features, and real-time data analysis. Traders can access a wide range of markets and customize their trading experience with the ability to share ideas and collaborate with other users. The interactive charts and technical analysis tools make TradingView a standout choice for forex traders.

eToro

eToro is a social trading platform that allows users to follow and copy the trades of successful traders. It offers a user-friendly interface, a wide range of assets to trade, and a community of traders to connect with. eToro’s CopyTrader feature enables users to replicate the trades of top-performing investors, making it an attractive option for beginners and experienced traders alike.

Forex.com

Forex.com is a well-established forex trading app that offers a range of tools and resources for traders of all levels. It provides access to a variety of markets, real-time data, and a user-friendly interface that makes it easy to navigate. Traders can access educational resources, market analysis, and trading signals to help them make informed decisions.

IQ Option

IQ Option is a popular trading app known for its user-friendly interface, low minimum deposit requirements, and a variety of trading instruments. It offers a range of analysis tools, customizable charts, and the ability to trade forex, stocks, cryptocurrencies, and more. IQ Option’s mobile app is easy to use and provides access to a range of features that cater to both beginner and advanced traders.

Trading Tools and Analysis: Best Trading Apps For Forex

When it comes to trading in the forex market, having access to the right tools and analysis is crucial for making informed decisions. Let’s explore the various tools available in the best trading apps for forex and how they assist traders in their trading journey.

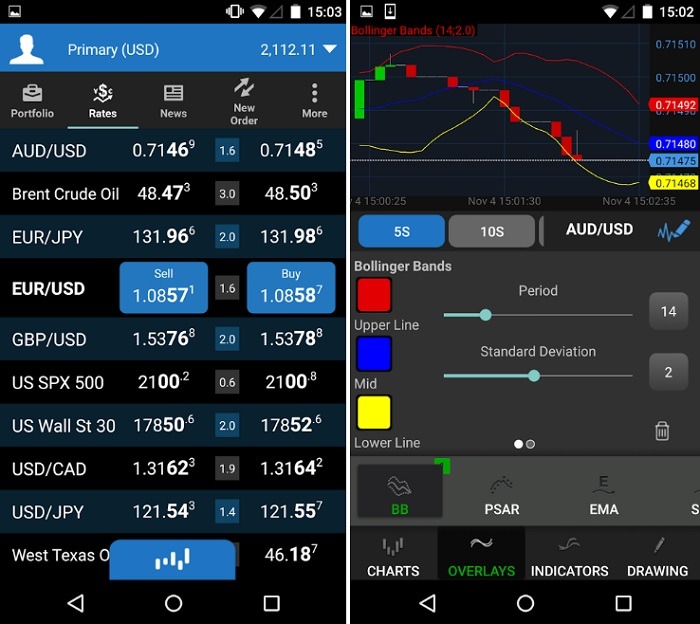

Charting Capabilities and Indicators

One of the key features of trading apps for forex is their charting capabilities. These apps provide traders with advanced charting tools that allow them to visualize price movements and patterns in the market. Traders can customize their charts with different timeframes, styles, and indicators to suit their trading strategies.

- Technical Indicators: The best trading apps offer a wide range of technical indicators such as moving averages, MACD, RSI, and Bollinger Bands. These indicators help traders analyze price trends, momentum, volatility, and overbought or oversold conditions in the market.

- Drawing Tools: Traders can use drawing tools like trendlines, channels, and Fibonacci retracements to identify potential entry and exit points in the market. These tools help traders make accurate predictions about future price movements.

- Customizable Alerts: Trading apps allow traders to set up customizable alerts based on their trading preferences. Traders can receive notifications when certain price levels are reached or when specific trading conditions are met.

Trading Pairs and Market Access

When it comes to trading forex, the range of trading pairs offered by trading apps can significantly impact the opportunities available to traders. Let’s explore the types of trading pairs and market access provided by these apps.

Types of Trading Pairs

- Major Currency Pairs: These pairs include the most traded currencies in the forex market, such as EUR/USD, USD/JPY, and GBP/USD.

- Minor Currency Pairs: Also known as cross-currency pairs, these pairs do not include the US dollar and are less liquid than major pairs. Examples include EUR/GBP and AUD/JPY.

- Exotic Currency Pairs: These pairs consist of one major currency and one currency from a developing economy. Exotic pairs have higher spreads and are more volatile. Examples include USD/TRY and EUR/SEK.

Market Access

- Stocks: Some trading apps offer access to stock trading, allowing traders to diversify their portfolios and take advantage of opportunities in the stock market.

- Commodities: Trading apps may also provide access to trading commodities like gold, silver, oil, and agricultural products. This enables traders to hedge against inflation and diversify their investments.

- Cryptocurrencies: With the rise of cryptocurrencies, many trading apps now offer access to popular digital assets like Bitcoin, Ethereum, and Litecoin. Traders can take advantage of the volatility in the crypto market to profit from price movements.

Account Management and Security

When it comes to trading apps for forex, account management and security are crucial aspects that traders need to consider. These apps provide users with a seamless account setup process while ensuring the safety of their funds and data.

Account Setup Process

- Users can easily create an account on these trading apps by providing their personal information and verifying their identity.

- Once the account is created, users may need to complete a KYC (Know Your Customer) process to comply with regulatory requirements.

- Some apps may offer different account types based on the trader’s experience level and trading preferences.

Security Measures

- Trading apps use encryption technology to protect users’ data from unauthorized access.

- Two-factor authentication (2FA) is commonly used to add an extra layer of security to the account.

- Regular security updates and audits are conducted to ensure the platform’s security standards are up to date.

Funds and Data Safety

- Segregated accounts are used to separate users’ funds from the company’s operational funds, ensuring that traders’ money is safe even in the event of the company’s insolvency.

- Trading apps adhere to strict regulatory standards to safeguard users’ funds and ensure transparency in financial transactions.

- Data protection policies are in place to prevent unauthorized sharing or misuse of users’ personal information.

Deposits, Withdrawals, and Account Management

- Users can deposit funds into their trading accounts using various payment methods, such as bank transfers, credit/debit cards, or e-wallets.

- Withdrawals are processed securely, and users may need to go through a verification process to ensure the funds are sent to the correct recipient.

- Account management features allow users to monitor their trading activity, track their performance, and make adjustments to their trading strategies.

In conclusion, the best trading apps for forex offer a seamless trading experience with advanced tools and a user-friendly interface. Whether you’re a beginner or seasoned trader, these apps provide the necessary resources to thrive in the dynamic forex market. Dive in and elevate your trading game today!

Understanding the importance of economic data in forex is crucial for traders to make informed decisions. Economic indicators such as GDP, employment rates, and inflation can significantly impact currency values. By analyzing these data points, traders can anticipate market movements and adjust their strategies accordingly.

Properly managing risk in forex trading is essential for preserving capital and achieving long-term success. Techniques such as setting stop-loss orders, diversifying investments, and using leverage wisely can help traders mitigate potential losses and protect their funds from market volatility.

Implementing effective forex money management strategies is key to sustaining profitability in the forex market. Strategies like position sizing, risk-reward ratios, and maintaining discipline in trading can help traders optimize their profits while minimizing potential risks.