Bond ratings and risk play a crucial role in the world of investments, guiding both investors and issuers towards informed decisions that can impact financial outcomes significantly. Dive into the complexities of bond ratings and risk to uncover their importance in the market.

Understanding Bond Ratings

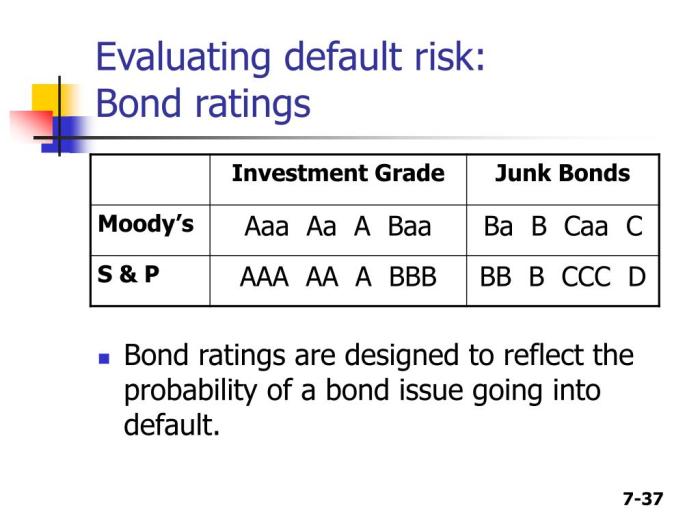

Bond ratings are assessments of the creditworthiness of bond issuers, indicating the likelihood of the issuer defaulting on their debt obligations. These ratings are assigned by various credit rating agencies based on the issuer’s financial stability, ability to repay debt, and overall credit risk.

Bond Rating Agencies and Scales

- Standard & Poor’s (S&P): One of the most well-known rating agencies, uses a scale ranging from AAA (highest credit quality) to D (default).

- Moody’s Investors Service: Another prominent agency, uses a similar scale with ratings like Aaa (highest quality) to C (highly speculative).

- Fitch Ratings: Utilizes a rating scale from AAA (highest credit quality) to D (default).

Significance of Bond Ratings

Bond ratings are crucial for both investors and issuers. For investors, these ratings provide insights into the risk associated with a particular bond, helping them make informed investment decisions. Higher-rated bonds typically offer lower returns but are considered safer investments. On the other hand, issuers benefit from higher ratings as they can attract investors more easily and secure financing at lower interest rates.

Factors Influencing Bond Ratings: Bond Ratings And Risk

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Bonds_Rated_Sep_2020-01-b7e5fc745626478bbb0eed1fb5016cac.jpg?w=700)

When determining bond ratings, several key factors come into play that can significantly impact the assessment of a bond’s creditworthiness. These factors include credit risk, interest rate risk, market risk, economic conditions, industry trends, financial statements, and credit analysis.

Credit Risk

Credit risk is one of the primary factors influencing bond ratings. It refers to the risk that the issuer of the bond may default on its payments. Bond ratings agencies assess the credit risk by evaluating the issuer’s financial stability, past payment history, and overall creditworthiness.

Interest Rate Risk

Interest rate risk is another crucial factor in determining bond ratings. This risk stems from changes in interest rates, which can affect the value of a bond. Bonds with longer maturities are more exposed to interest rate risk compared to short-term bonds.

Market Risk, Bond ratings and risk

Market risk, also known as systemic risk, refers to the overall volatility and uncertainty in the financial markets. Factors such as geopolitical events, economic indicators, and market sentiment can impact bond ratings. Bonds issued by companies in volatile industries may be more susceptible to market risk.

Economic Conditions and Industry Trends

Economic conditions and industry trends play a significant role in influencing bond ratings. A strong economy and positive industry outlook can lead to higher bond ratings, indicating lower risk. Conversely, a weak economy or unfavorable industry trends may result in lower bond ratings.

Financial Statements and Credit Analysis

Financial statements and credit analysis are essential components in determining bond ratings. Bond ratings agencies review an issuer’s financial statements to assess its financial health, liquidity, and ability to meet its debt obligations. Credit analysis involves a detailed examination of the issuer’s creditworthiness based on various financial metrics and qualitative factors.

Types of Bond Ratings

:max_bytes(150000):strip_icc()/dotdash_INV_final_Ba3-BB-_Jan_2021-01-4dd68057e7a241629de924cee6005773.jpg?w=700)

Investors rely on bond ratings to assess the creditworthiness of bond issuers, helping them make informed investment decisions. Bond ratings are categorized into two main groups: investment-grade and non-investment-grade, also known as high-yield or speculative-grade ratings.

Investment-Grade vs. Non-Investment-Grade Ratings

- Investment-Grade: Bonds with ratings of AAA, AA, A, and BBB are considered investment-grade. These ratings indicate a lower risk of default, as the issuers have a strong ability to meet their financial obligations.

- Non-Investment-Grade: Bonds with ratings of BB, B, CCC, and D fall into the non-investment-grade category. These bonds are considered riskier investments, as the issuers may have a higher likelihood of default.

Meaning of Bond Ratings

- AAA: The highest rating assigned by credit rating agencies, indicating an extremely low risk of default.

- AA, A, BBB: These ratings signify varying degrees of creditworthiness, with AA being higher than A and so on.

- BB, B: Bonds in this category are considered speculative or junk bonds, with a higher risk of default.

- CCC: Bonds rated CCC are at a significantly high risk of default, and investors should exercise caution when considering such investments.

- D: Bonds rated D are in default or are expected to default, indicating the highest level of risk.

Implications of Bond Ratings on Risk and Return

- Higher-rated bonds (such as AAA or AA) typically offer lower yields but come with lower risk, making them suitable for conservative investors seeking stability.

- Lower-rated bonds (such as BB or B) offer higher yields to compensate for the increased risk, attracting investors looking for higher returns but willing to take on more risk.

- Investors should carefully consider the risk-return trade-off when selecting bonds based on their ratings, aligning with their risk tolerance and investment objectives.

Risk Assessment in Bond Ratings

When it comes to evaluating bond investments, risk assessment plays a crucial role in determining the creditworthiness of a bond issuer and the likelihood of default. Bond ratings provide investors with valuable insights into the credit risk, default risk, and overall risk associated with a particular bond.

Assessing Credit Risk

Credit risk is a fundamental aspect of bond ratings, reflecting the issuer’s ability to meet its debt obligations. Bond ratings agencies assess an issuer’s financial health, past repayment history, and overall creditworthiness to determine the credit risk associated with a bond. Higher credit ratings indicate lower credit risk, while lower ratings suggest higher credit risk.

- Bond ratings agencies consider factors such as the issuer’s financial stability, cash flow, leverage, and industry trends when assessing credit risk.

- Investors use credit ratings to gauge the likelihood of a bond issuer defaulting on its payments and adjust their investment decisions accordingly.

Default Risk and Overall Risk

Default risk refers to the probability of a bond issuer failing to make interest payments or repay the principal amount. Bond ratings provide insights into the default risk associated with a bond, helping investors assess the likelihood of facing losses due to issuer default. Overall risk, on the other hand, encompasses all risks associated with a bond investment, including credit risk, interest rate risk, and market risk.

- Bond ratings agencies evaluate various factors to assess default risk, such as the issuer’s financial strength, debt levels, and economic conditions.

- Investors rely on bond ratings to understand the overall risk profile of a bond and make informed decisions based on their risk tolerance and investment objectives.

Risk-Adjusted Returns

Risk-adjusted returns take into account the level of risk associated with an investment to determine whether the potential returns justify the risk taken. In the context of bond ratings, investors analyze the risk-adjusted returns of a bond to assess whether the expected return compensates for the associated risks.

- Higher-rated bonds typically offer lower yields but come with lower risk, resulting in lower risk-adjusted returns.

- Investors with higher risk tolerance may opt for lower-rated bonds that offer higher yields but come with increased default risk, leading to higher risk-adjusted returns.

In conclusion, understanding bond ratings and risk is essential for navigating the intricate landscape of investments with confidence and clarity. By grasping the implications of different bond ratings, investors can make sound decisions tailored to their risk tolerance levels.