Bonds vs stocks: which is better sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

In this insightful comparison, we delve into the world of investing to uncover the nuances between bonds and stocks, shedding light on their unique characteristics and potential benefits for investors.

Bonds vs Stocks

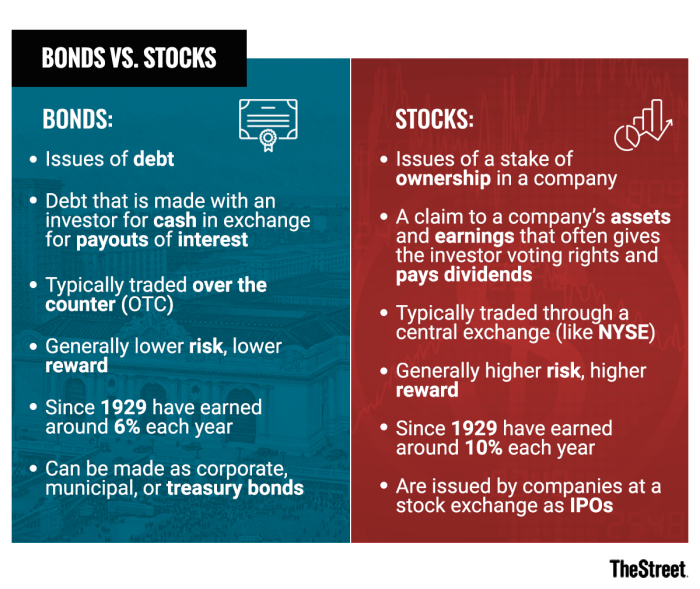

When comparing bonds and stocks, it’s essential to understand the fundamental differences between these two types of investments. Bonds represent debt securities issued by governments or corporations, while stocks represent ownership shares in a company. Let’s delve into the key disparities and features of bonds and stocks.

Overview of Bonds and Stocks

Bonds:

- Bonds are debt instruments where the issuer borrows funds from investors for a defined period at a fixed or variable interest rate.

- Investors who purchase bonds become creditors of the issuer and receive periodic interest payments until the bond matures, at which point the principal is repaid.

- Examples of bonds include U.S. Treasury bonds, corporate bonds, municipal bonds, and savings bonds.

Stocks:

- Stocks represent ownership stakes in a company, giving shareholders voting rights and the potential to receive dividends and capital appreciation.

- Stockholders bear the risk of fluctuating stock prices and may benefit from the company’s success through higher stock prices or suffer losses if the stock value declines.

- Examples of stocks include shares of publicly traded companies like Apple, Microsoft, and Amazon.

Risk and Return: Bonds Vs Stocks: Which Is Better

When it comes to investing in financial markets, understanding the relationship between risk and return is crucial. Both bonds and stocks offer investors the potential for returns, but they also come with different levels of risk.

Risk Comparison

- Bonds are generally considered less risky than stocks. When you invest in bonds, you are essentially lending money to a corporation or government entity in exchange for regular interest payments and the return of the principal amount at maturity. Since bondholders have a higher claim on assets in case of bankruptcy, bonds are considered a safer investment option.

- On the other hand, investing in stocks means owning a portion of a company. Stock prices are more volatile and can fluctuate based on various factors such as market conditions, company performance, and economic outlook. This volatility exposes stock investors to higher risk compared to bondholders.

Return Comparison

- Historically, stocks have provided higher returns than bonds over the long term. This higher return potential is due to the growth and profit potential of companies in which investors hold shares.

- Bonds, on the other hand, offer lower returns compared to stocks but provide a more predictable income stream through interest payments. The return on bonds is primarily driven by the interest rate environment and the credit quality of the issuer.

Interconnection of Risk and Return

- The relationship between risk and return is a key factor in investment decision-making. Generally, higher returns are associated with higher levels of risk. Investors need to balance their risk tolerance with their return expectations when choosing between bonds and stocks.

- While stocks offer the potential for higher returns, they also come with higher volatility and risk. Bonds, on the other hand, provide a more stable income stream but with lower return potential. Understanding this trade-off is essential for building a well-diversified investment portfolio.

Income Generation

When it comes to income generation, both bonds and stocks offer opportunities for investors to earn returns on their investments. Let’s delve into how each asset class generates income.

Bonds

Bonds are debt securities issued by governments, municipalities, or corporations to raise capital. When investors purchase bonds, they are essentially lending money to the bond issuer in exchange for periodic interest payments, known as coupon payments. These payments are typically fixed and paid out semi-annually or annually. At the end of the bond’s term, the investor receives the principal amount back, assuming the issuer does not default. The income generated from bonds is considered more predictable and stable compared to stocks.

Stocks, Bonds vs stocks: which is better

Stocks represent ownership in a company, and shareholders are entitled to a portion of the company’s profits in the form of dividends. While dividends are not guaranteed and can fluctuate based on the company’s performance, many established companies have a history of paying dividends regularly. Additionally, investors can also generate income from stocks through capital appreciation, where the stock price increases, allowing them to sell their shares at a profit.

Comparison

When comparing the income generation potential of bonds and stocks, it’s essential to consider the trade-off between risk and return. Bonds typically provide a more consistent income stream through fixed coupon payments, making them attractive to investors seeking stable income. On the other hand, stocks offer the potential for higher returns through dividends and capital appreciation but come with greater volatility and risk. Investors often balance their portfolios with a mix of bonds and stocks to achieve their desired level of income and risk tolerance.

Market Volatility

Market volatility can have a significant impact on both bonds and stocks, affecting their prices and overall performance. Let’s analyze how these two asset classes react to market volatility and the influence of economic conditions on their volatility.

Bonds

Bonds are generally considered less volatile than stocks due to their fixed interest payments and maturity dates. During periods of market volatility, investors often turn to bonds as a safe haven, driving up bond prices and lowering yields. However, certain types of bonds, such as high-yield or junk bonds, can be more sensitive to market fluctuations. For example, during the 2008 financial crisis, corporate bonds experienced increased volatility as credit ratings and default risks came into focus.

Stocks, Bonds vs stocks: which is better

Stocks are known for their higher volatility compared to bonds, as their prices can fluctuate significantly in response to market conditions. Economic factors such as interest rates, inflation, and geopolitical events can all impact stock prices. During times of market volatility, stock prices may experience sharp declines or gains, reflecting investor sentiment and market uncertainty. For instance, the tech bubble burst in the early 2000s led to a significant drop in stock prices, causing high volatility in the equity markets.

Impact of Economic Conditions

Economic conditions play a crucial role in determining the volatility of both bonds and stocks. Factors such as GDP growth, employment data, and central bank policies can affect market sentiment and investor confidence. For example, an economic recession can lead to increased volatility in both bond and stock markets as investors reevaluate their risk exposure and asset allocation.

Historical Examples

– The 2008 financial crisis: Bond prices surged as investors sought safety, while stocks experienced a sharp decline in value.

– Dot-com bubble burst (early 2000s): Stock prices plummeted due to overvaluation, resulting in high volatility in the equity markets.

– COVID-19 pandemic (2020): Bond yields fell to historic lows, driving up bond prices, while stock markets experienced rapid fluctuations in response to the global health crisis.

As we wrap up our exploration of Bonds vs stocks: which is better, it becomes evident that both investment options have their own merits and considerations. Whether you prefer the stability of bonds or the growth potential of stocks, understanding the dynamics of these financial instruments is crucial for making informed investment decisions.