Building a trading mindset for forex sets the foundation for success in the unpredictable world of trading. From cultivating discipline to managing risks, this guide delves into the essential components of a strong mindset that can lead to profitable trades.

Explore the strategies and techniques that can help you navigate the psychological challenges of forex trading and emerge as a confident and resilient trader.

Why is a trading mindset important in forex?

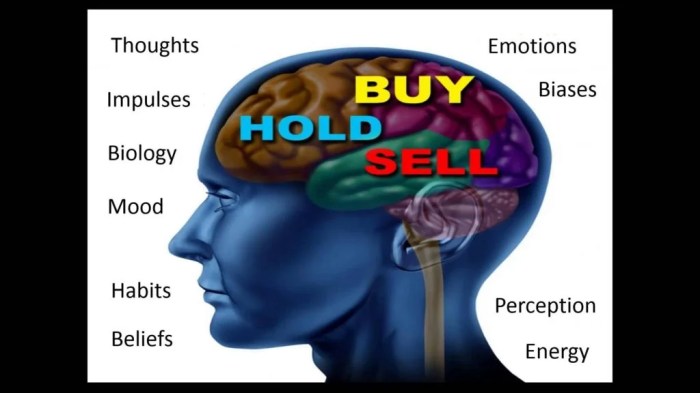

Having the right trading mindset is crucial in forex trading as it greatly impacts a trader’s success. A strong mindset can help traders make rational decisions, manage risks effectively, and stay disciplined during volatile market conditions. On the other hand, negative emotions such as fear, greed, or impatience can lead to impulsive actions and poor trading choices.

Impact of mindset on trading success

Maintaining a positive and disciplined mindset is essential for achieving success in forex trading. Traders with a clear focus, realistic goals, and a willingness to adapt to changing market conditions are more likely to make profitable trades. By staying calm and rational, traders can avoid making emotional decisions that may result in losses.

How emotions can affect trading decisions, Building a trading mindset for forex

Emotions play a significant role in forex trading and can influence trading decisions. For instance, fear can cause traders to exit trades too early, missing out on potential profits. Conversely, greed may lead to overtrading or taking excessive risks. By being aware of their emotions and practicing emotional control, traders can make more rational and strategic decisions.

Examples of how a strong mindset can lead to profitable trades

A trader with a strong mindset will follow a well-defined trading plan, stick to their risk management strategies, and remain focused on their long-term goals. This disciplined approach can lead to consistent profits over time, even in the face of market uncertainties. Additionally, a positive mindset can help traders learn from their mistakes, adapt to changing market conditions, and continuously improve their trading skills.

Developing a strong mindset for forex trading: Building A Trading Mindset For Forex

Developing a strong mindset is crucial for success in forex trading. It involves cultivating discipline, implementing effective risk management strategies, and staying focused to avoid emotional trading.

Strategies to cultivate a disciplined trading mindset

- Establish a trading plan: Define your goals, risk tolerance, and trading strategy before entering the market.

- Stick to your plan: Avoid making impulsive decisions and stay committed to your predefined rules.

- Practice patience: Understand that success in forex trading takes time and requires discipline to follow your strategy consistently.

- Educate yourself: Continuously learn and improve your trading skills to make informed decisions based on analysis rather than emotions.

The importance of risk management in shaping a trading mindset

Effective risk management is essential for maintaining a disciplined trading mindset. It helps traders protect their capital, minimize losses, and ensure long-term success in the forex market. By implementing risk management strategies such as setting stop-loss orders, position sizing, and diversification, traders can better control their exposure to market volatility and avoid emotional decision-making.

Techniques to stay focused and avoid emotional trading

- Practice mindfulness: Be aware of your emotions and thoughts while trading, and take breaks to refocus and maintain a clear mindset.

- Journal your trades: Keep a trading journal to track your decisions, analyze your performance, and identify patterns of emotional trading behavior.

- Set realistic goals: Avoid chasing unrealistic profits and focus on consistent, sustainable growth in your trading account.

- Seek support: Surround yourself with experienced traders, mentors, or a trading community to gain perspective, advice, and encouragement during challenging times.

Overcoming common psychological barriers

Psychological barriers can greatly impact a trader’s success in the forex market. Identifying and overcoming these barriers is crucial for maintaining a strong trading mindset.

Fear and Greed in Trading

Fear and greed are two of the most common emotions that can negatively affect a trader’s decision-making process. Fear can cause traders to hesitate or second-guess their trades, while greed can lead to impulsive and risky decisions.

- Acknowledge and understand your emotions: Recognize when fear or greed is influencing your trading decisions. Take a step back and reassess your strategy.

- Set clear trading goals: Establishing specific goals and sticking to your trading plan can help mitigate the impact of fear and greed.

- Practice risk management: Implement proper risk management techniques to minimize potential losses and prevent emotional decision-making.

Dealing with Losses and Maintaining a Positive Mindset

Experiencing losses is inevitable in forex trading, but how traders react to these losses can make a significant difference in their overall success.

- Accept losses as part of the trading process: Understand that losses are a natural part of trading and focus on learning from mistakes rather than dwelling on them.

- Stay disciplined and patient: Stick to your trading plan and avoid making impulsive decisions after a loss. Patience is key to long-term success.

- Practice self-care and mindfulness: Take breaks, exercise, and engage in activities that help reduce stress and maintain a positive mindset for trading.

Building confidence and resilience

Building confidence and resilience are key components of a successful forex trading mindset. Confidence allows traders to make decisions without hesitation, while resilience helps them bounce back from setbacks and failures.

Role of confidence in forex trading

Confidence is essential in forex trading as it enables traders to trust their analysis and make decisions based on their strategies. Without confidence, traders may second-guess themselves, leading to missed opportunities or impulsive decisions. A confident trader can stick to their trading plan and remain disciplined even in volatile market conditions.

- Believe in your analysis: Trust the research and analysis you have done before entering a trade. Confidence in your abilities can help you stay calm and focused.

- Practice makes perfect: The more you trade and gain experience, the more confident you will become in your decision-making process.

- Positive self-talk: Maintain a positive mindset by affirming your trading skills and capabilities. Avoid negative self-talk that can erode your confidence.

Boosting confidence in trading decisions

There are several methods traders can use to boost their confidence in trading decisions:

- Keep a trading journal: Record your trades, analysis, and emotions to track your progress and learn from past mistakes. Reflecting on successful trades can boost your confidence.

- Set realistic goals: Establish achievable trading goals and celebrate small wins along the way. Meeting your goals can build confidence in your trading abilities.

- Continuous learning: Stay informed about market trends, strategies, and analysis techniques to boost your knowledge and confidence in your trading decisions.

Role of resilience in overcoming setbacks

Resilience is the ability to bounce back from setbacks, losses, and failures in forex trading. It is crucial for traders to stay focused and motivated despite experiencing challenges in the market.

- Learn from failures: Use setbacks as learning opportunities to improve your trading strategy and decision-making process. Embrace failures as part of the learning curve.

- Stay disciplined: Stick to your trading plan and risk management strategy even in the face of losses. Resilience can help you remain focused on your long-term goals.

- Seek support: Surround yourself with a supportive trading community or mentor who can provide guidance and encouragement during difficult times. Sharing experiences with others can boost resilience.

In conclusion, developing a trading mindset for forex is not just about numbers and charts; it’s about mastering your emotions and mindset to make informed decisions. By overcoming psychological barriers and building confidence, you can enhance your trading journey and achieve long-term success in the forex market.

When it comes to using stop loss in forex , it is crucial for traders to minimize potential losses and protect their investments. By setting stop loss orders, traders can automatically exit a trade if the market moves against them, helping to manage risk effectively.

For those new to forex trading, understanding beginner forex risk management is essential. Learning how to calculate risk, set proper stop losses, and implement risk management strategies can help beginners navigate the market with more confidence and control.

When comparing forex trading platforms , traders should consider factors such as fees, available assets, customer support, and user interface. Choosing the right trading platform can significantly impact a trader’s overall experience and success in the forex market.