Kicking off with calculating risk-reward ratio in forex, this opening paragraph is designed to captivate and engage the readers, setting the tone for a comprehensive exploration of this essential aspect of forex trading.

Exploring the formula, significance of stop-loss and take-profit levels, and the impact of different ratios on trading performance, this article delves into the intricacies of risk-reward ratio in forex.

Understanding Risk-Reward Ratio

In the world of forex trading, the risk-reward ratio is a crucial metric that helps traders assess the potential profit against the potential loss in a trade. It is a way of quantifying the relationship between the risk taken in a trade and the potential reward that trade could bring.

Calculating the risk-reward ratio is essential for making informed trading decisions because it allows traders to evaluate whether a trade is worth taking based on the potential reward compared to the risk involved. By understanding this ratio, traders can better manage their risk exposure and optimize their trading strategies for long-term success.

Importance of Risk-Reward Ratio

- By knowing the risk-reward ratio, traders can set realistic profit targets and stop-loss levels based on their risk tolerance and trading goals.

- It helps traders maintain a favorable risk-reward profile, where the potential reward outweighs the risk taken, increasing the probability of profitable trades.

- Traders can use the risk-reward ratio to filter out trades that do not offer a favorable risk-reward profile, thus avoiding unnecessary losses.

Examples of Risk-Reward Ratio in Trading Strategies

- Trader A identifies a trade setup with a risk-reward ratio of 1:2, meaning for every $1 risked, there is a potential reward of $2. This favorable ratio prompts Trader A to take the trade as it aligns with their risk management strategy.

- Trader B analyzes a trade with a risk-reward ratio of 1:1, where the potential reward equals the risk. Trader B decides to skip this trade as it does not offer a sufficient reward to justify the risk involved.

- Trader C considers a trade opportunity with a risk-reward ratio of 1:3, indicating a potential reward three times the risk taken. This attractive ratio encourages Trader C to enter the trade with confidence.

Calculating Risk-Reward Ratio

When trading in the forex market, calculating the risk-reward ratio is a crucial step to manage your trades effectively. This ratio helps traders determine the potential profit compared to the amount they are risking on a trade.

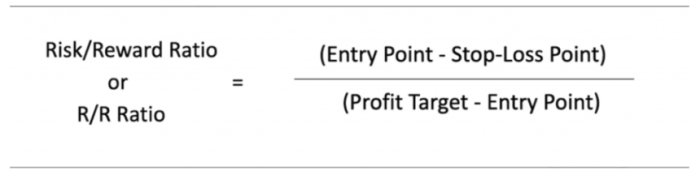

Formula for Calculating Risk-Reward Ratio

To calculate the risk-reward ratio, you can use the following formula:

Risk-Reward Ratio = (Take Profit Price – Entry Price) / (Entry Price – Stop Loss Price)

This formula allows traders to assess whether the potential profit of a trade is worth the risk involved.

Significance of Setting Stop-Loss and Take-Profit Levels

Setting stop-loss and take-profit levels is essential when calculating the risk-reward ratio. Stop-loss levels help traders limit potential losses by automatically closing a trade if the price moves against them. On the other hand, take-profit levels allow traders to secure profits by automatically closing a trade when the price reaches a certain target.

Impact of Different Risk-Reward Ratios on Trading Performance

Different risk-reward ratios can have a significant impact on overall trading performance. A higher risk-reward ratio means that traders are aiming for larger profits compared to their potential losses. While this can result in fewer winning trades, the profits from successful trades can outweigh the losses, leading to a positive overall outcome. On the other hand, a lower risk-reward ratio may result in more winning trades but could lead to losses outweighing profits if not managed effectively.

Factors Influencing Risk-Reward Ratio

When determining the risk-reward ratio in forex trading, traders take into account various factors that can influence their decision-making process. These factors play a crucial role in assessing the potential risks and rewards of a trade, helping traders make informed choices to manage their portfolios effectively.

Market Volatility:

Market volatility is a key factor that affects the risk-reward ratio calculation in forex trading. Higher volatility generally implies greater price fluctuations, which can result in larger potential gains or losses. Traders often adjust their risk-reward ratio based on the level of volatility in the market, aiming to strike a balance between risk and reward. A more volatile market may lead traders to widen their stop-loss orders or reduce their position size to account for the increased risk.

Trader’s Risk Tolerance:

Another important factor that influences the risk-reward ratio preferences of traders is their individual risk tolerance. Every trader has a unique risk appetite and comfort level when it comes to taking on risk in the market. Some traders may be more conservative and prefer a lower risk-reward ratio to protect their capital, while others with a higher risk tolerance may opt for a higher risk-reward ratio to potentially achieve greater returns. Understanding one’s risk tolerance is crucial in determining the appropriate risk-reward ratio for each trade.

Overall, market volatility and a trader’s risk tolerance are significant factors that traders consider when evaluating their risk-reward ratio in forex trading. By carefully analyzing these factors and adjusting their risk management strategies accordingly, traders can optimize their trading performance and achieve their financial goals.

Strategies for Improving Risk-Reward Ratio: Calculating Risk-reward Ratio In Forex

To optimize the risk-reward ratio in forex trading, traders can implement various strategies that focus on effective risk management practices. By adjusting trade parameters and employing proven techniques, traders can enhance their risk-reward ratio and potentially improve their overall profitability.

Implement Proper Position Sizing, Calculating risk-reward ratio in forex

Proper position sizing is crucial for improving the risk-reward ratio in forex trading. By determining the appropriate amount of capital to risk on each trade based on account size and risk tolerance, traders can better manage their exposure to potential losses. Utilizing techniques like the 2% rule, where traders risk no more than 2% of their trading capital on any single trade, can help maintain a balanced risk-reward ratio.

Set Realistic Stop-Loss and Take-Profit Levels

Setting realistic stop-loss and take-profit levels is essential for optimizing the risk-reward ratio. By placing stop-loss orders at strategic levels to limit potential losses and take-profit orders to secure profits at predetermined targets, traders can ensure that each trade has a favorable risk-reward profile. Utilizing technical analysis tools and market research can assist in identifying optimal entry and exit points for trades.

Utilize Trailing Stop-Loss Orders

Trailing stop-loss orders can be used to lock in profits and protect against potential reversals in the market. By adjusting stop-loss levels as the trade moves in favor of the trader, trailing stop-loss orders allow for the possibility of capturing additional gains while minimizing losses. This technique can help improve the risk-reward ratio by capitalizing on profitable trades and reducing the impact of losing trades.

Diversify Your Trading Portfolio

Diversifying your trading portfolio across different currency pairs and asset classes can help spread risk and improve the overall risk-reward ratio. By avoiding over-concentration in a single trade or market, traders can reduce the impact of adverse price movements on their capital. Implementing a well-rounded trading strategy that includes a mix of assets can enhance the risk-reward profile of the overall portfolio.

In conclusion, understanding and effectively calculating the risk-reward ratio is key to success in forex trading. By implementing sound strategies and managing risk carefully, traders can optimize their trading performance and enhance their overall profitability.

When it comes to price action trading strategies in forex , traders rely on analyzing raw price movements. This method helps them make informed decisions based on historical price data without the use of indicators.

For those interested in forex technical analysis strategies , understanding market trends and patterns is crucial. By studying charts and indicators, traders can predict future price movements and optimize their trading decisions.

Looking to trade forex with a different approach? Explore forex trading strategy without indicators for a more simplistic and intuitive trading experience. This strategy focuses on price movements and chart patterns for decision-making.