Kicking off with comparing forex trading platforms, this opening paragraph is designed to captivate and engage the readers, setting the tone for what’s to come in this comprehensive discussion. When it comes to navigating the world of forex trading, choosing the right platform can make all the difference. From understanding the basics to delving into platform performance and mobile capabilities, this guide covers it all.

The Basics of Forex Trading Platforms

Forex trading platforms are software applications that allow traders to access the foreign exchange market and execute trades. These platforms provide tools and features that are essential for analyzing the market, placing trades, and managing positions.

Key Features of a Reliable Forex Trading Platform

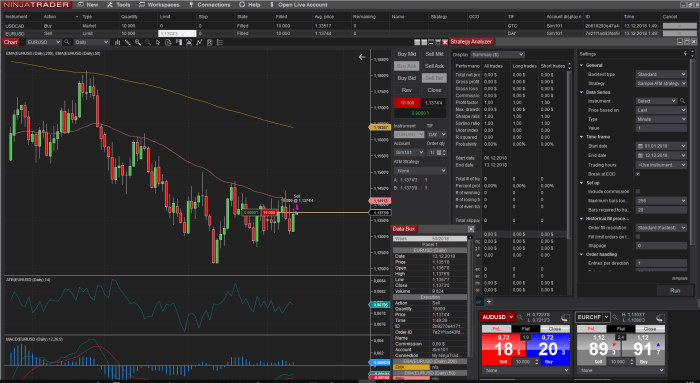

- Real-time quotes and charts: A reliable forex trading platform should provide up-to-date market data to help traders make informed decisions.

- Order execution: The platform should offer fast and accurate order execution to ensure that trades are executed at the desired price.

- Risk management tools: Features like stop-loss orders and take-profit orders help traders manage risk effectively.

- Technical analysis tools: The platform should have a variety of technical indicators and charting tools for analyzing price movements.

Web-based vs. Desktop Forex Trading Platforms

Web-based forex trading platforms are accessed through a web browser and do not require any software installation. They offer the convenience of trading from any device with an internet connection. On the other hand, desktop platforms are installed on the trader’s computer and may offer more advanced features and customization options.

Importance of User-Friendly Interfaces in Forex Trading Platforms, Comparing forex trading platforms

- Easy navigation: A user-friendly interface makes it easy for traders to find the tools and features they need quickly.

- Intuitive design: Clear and intuitive design helps traders focus on trading without being distracted by complex layouts.

- Customization options: The ability to customize the interface allows traders to personalize their trading environment for better efficiency.

Key Factors to Consider When Comparing Forex Trading Platforms

When comparing forex trading platforms, there are several key factors that traders need to consider to ensure they choose the platform that best suits their needs. From regulatory compliance to transaction costs, each factor plays a crucial role in determining the overall trading experience.

Significance of Regulatory Compliance

Regulatory compliance is a crucial factor to consider when choosing a forex trading platform. Platforms that are regulated by reputable financial authorities provide traders with an added layer of security and protection. Regulatory oversight ensures that the platform operates in a transparent and fair manner, safeguarding the interests of traders.

Essential Tools and Indicators

Top forex trading platforms offer a wide range of essential tools and indicators to help traders make informed decisions. These tools may include technical analysis tools, charting capabilities, economic calendars, and risk management features. Traders should look for platforms that provide access to a comprehensive set of tools to enhance their trading experience.

Availability of Demo Accounts and Educational Resources

Demo accounts and educational resources are essential for traders, especially beginners, to practice trading strategies and improve their skills without risking real money. When comparing forex trading platforms, traders should consider the availability of demo accounts and educational resources. Platforms that offer robust educational materials, such as tutorials, webinars, and trading guides, can help traders develop their knowledge and expertise.

Impact of Transaction Costs and Spreads

Transaction costs and spreads can significantly impact a trader’s profitability. When comparing forex trading platforms, traders should pay close attention to the transaction costs, including spreads and commissions. Platforms that offer competitive spreads and low transaction costs can help traders maximize their profits. Additionally, traders should consider the execution speed and quality of trade orders to ensure efficient trading.

Platform Performance and Execution Speed

When it comes to forex trading, platform performance and execution speed play a crucial role in determining the success of a trader. Fast execution speeds are essential in forex trading as they can impact the price at which a trade is executed, especially during volatile market conditions.

The Importance of Fast Execution Speeds

- Fast execution speeds can help traders take advantage of fleeting opportunities in the market.

- Delays in order processing can result in slippage, where the trade is executed at a different price than expected.

- High execution speeds are crucial for scalpers and day traders who rely on quick trades to make profits.

Order Processing and Trade Execution

- Some platforms use straight-through processing (STP) to execute trades directly without intervention, leading to faster execution.

- Market makers may have a slower execution speed as they act as counterparties to trades, potentially leading to conflicts of interest.

Reliability During High Volatility Periods

- During high volatility periods, platform reliability is put to the test as order processing may slow down due to increased trading activity.

- Platforms that can handle high volumes of trades without disruptions are considered more reliable in such conditions.

Latency and Slippage in Platform Performance

- Latency refers to the delay between placing an order and its execution, which can lead to slippage.

- Slippage occurs when the trade is executed at a different price due to delays in order processing.

- Platforms with low latency and minimal slippage are preferred by traders to ensure accurate trade execution.

Mobile Trading Capabilities

Mobile trading has become increasingly popular in the forex market due to the convenience and accessibility it offers to traders. With the rise of smartphones and tablets, traders can now execute trades and monitor the market on-the-go, without being tied to a desktop computer.

Mobile Trading Apps Comparison

When comparing forex trading platforms, it’s essential to evaluate the mobile trading apps they offer. Some key factors to consider include ease of use, functionality, and speed. Look for apps that provide real-time quotes, advanced charting tools, and order management capabilities. Additionally, ensure that the app is compatible with your device’s operating system and offers a seamless trading experience.

- MetaTrader 4: One of the most popular trading platforms in the forex market, MetaTrader 4 offers a mobile app that allows traders to access their accounts and trade on the go. The app features real-time quotes, interactive charts, and a user-friendly interface.

- cTrader: Another well-known platform, cTrader also offers a mobile app with advanced trading features. Traders can place orders, analyze charts, and manage their positions directly from their mobile devices.

- Thinkorswim: This platform by TD Ameritrade provides a mobile app that offers a wide range of trading tools and features. Traders can access real-time data, trade equities, options, and futures, and monitor their portfolios from anywhere.

Impact of Mobile Trading

Mobile trading apps have revolutionized the way traders engage with the forex market. By allowing traders to stay connected and trade from anywhere, these apps have increased accessibility and convenience. Traders no longer need to be tied to a desktop computer to execute trades or monitor the market, enabling them to take advantage of trading opportunities in real-time.

In conclusion, comparing forex trading platforms involves a careful evaluation of various factors, from regulatory compliance to execution speeds and mobile trading capabilities. By considering these aspects, traders can make informed decisions to enhance their trading experience and achieve their financial goals. Stay informed, stay profitable, and happy trading!

When it comes to trading with small accounts, having the best forex strategies for small accounts is crucial. These strategies are specifically tailored to maximize profits while minimizing risks for traders with limited capital.

One popular approach in forex trading is the forex breakout trading strategy. This strategy involves identifying key levels where price tends to break out and make significant moves, allowing traders to capitalize on these movements.

The importance of economic data in forex cannot be understated. Economic indicators and data releases have a direct impact on currency values, making it essential for traders to stay informed and adjust their strategies accordingly.