Controlling risk with leverage in forex is a crucial aspect of successful trading. Dive into the world of forex trading as we explore the techniques and strategies to manage risk effectively.

Understanding how leverage impacts your trading decisions and the importance of risk management will be key takeaways from this insightful discussion.

Understanding Leverage in Forex Trading

Leverage in forex trading refers to the use of borrowed funds to increase the potential return on an investment. It allows traders to control a larger position with a smaller amount of capital. While leverage can amplify profits, it also significantly increases the risk of losses.

How Leverage Can Magnify Gains and Losses

When a trader uses leverage in forex trading, even a small price movement can lead to substantial profits or losses. For example, with a leverage ratio of 1:100, a 1% change in the exchange rate can result in a 100% gain or loss on the initial investment.

When it comes to forex trading, conducting fundamental analysis is crucial for making informed decisions. By analyzing economic indicators, geopolitical events, and market news, traders can better understand the underlying factors affecting currency values.

Common Leverage Ratios in Forex Trading

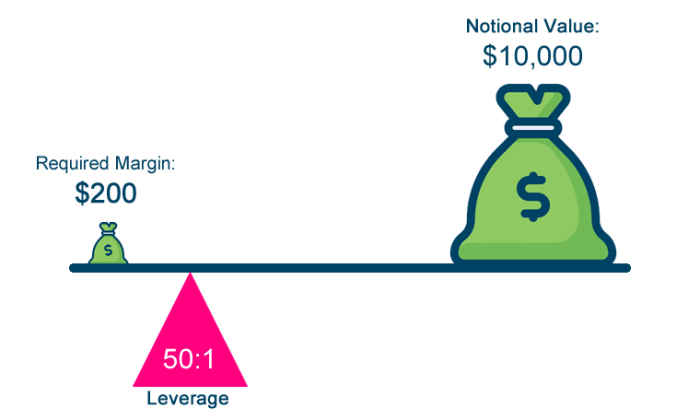

- A commonly used leverage ratio in forex trading is 1:50, which means that for every $1 in the trading account, the trader can control a position worth $50.

- Another popular leverage ratio is 1:100, allowing traders to control a position that is 100 times larger than their initial investment.

- Some brokers offer leverage ratios as high as 1:500, giving traders the ability to control very large positions with a relatively small amount of capital.

Risks Associated with Leverage

When trading forex with leverage, there are several risks that traders need to be aware of in order to protect their investments and manage their positions effectively.

Leverage can amplify both profits and losses, meaning that while it can increase the potential returns on a trade, it also significantly increases the risks involved. One of the main risks associated with leverage is the potential for margin calls.

Margin Calls and Leverage, Controlling risk with leverage in forex

Margin calls occur when a trader’s account balance falls below the required margin level to maintain an open position. This can happen when a trade moves against the trader, leading to losses that exceed the initial investment. In such cases, the broker may issue a margin call, requiring the trader to either deposit more funds into the account or close the position to limit further losses.

To avoid margin calls and mitigate the risks associated with leverage, it is crucial for traders to implement effective risk management strategies. This includes setting stop-loss orders, diversifying their portfolio, and only trading with funds that they can afford to lose. By carefully managing their risk exposure, traders can protect their capital and ensure long-term success in the forex market.

Controlling Risk with Leverage: Controlling Risk With Leverage In Forex

When it comes to forex trading, leveraging can amplify both profits and losses. Therefore, it is crucial for traders to have effective risk management strategies in place to control the risks associated with leverage.

Stop-Loss Orders vs. Other Risk Management Tools

One of the most common techniques for controlling risk in forex trading is through the use of stop-loss orders. These orders allow traders to automatically exit a trade when a certain price level is reached, limiting potential losses. However, there are other risk management tools available that traders can use in conjunction with or in place of stop-loss orders.

- Trailing Stops: Trailing stops move with the market price, locking in profits as the trade moves in the trader’s favor while protecting against potential losses if the market reverses.

- Position Sizing: By adjusting the size of their positions based on the level of leverage used, traders can effectively manage risk. This involves calculating the appropriate position size to limit potential losses to a certain percentage of the trading account.

- Hedging: Hedging involves opening a trade in the opposite direction to an existing position to offset potential losses. While this can reduce risk, it also limits potential profits.

Adjusting Leverage for Risk Management

Traders can also adjust their leverage to manage risk effectively. By reducing the amount of leverage used in a trade, traders can lower the risk of significant losses. This can be particularly important during periods of high market volatility or uncertainty.

It is essential for traders to strike a balance between maximizing potential profits through leverage and protecting against excessive losses.

Impact of Leverage on Trading Psychology

When it comes to trading in the forex market, leverage can have a significant impact on a trader’s psychology. The ability to control larger positions with a smaller amount of capital can lead to both increased profits and heightened risks. This dynamic can influence a trader’s mindset and decision-making processes, often leading to emotional responses that may not align with a well-thought-out trading strategy.

Effects on Trader’s Mindset and Decision-making

- Leverage can create a false sense of security, leading traders to take on more risk than they can afford.

- Excessive leverage can amplify both gains and losses, causing emotional swings that may cloud judgment.

- Traders may become overconfident when experiencing success with leveraged trades, leading to impulsive decision-making.

Maintaining Emotional Control and Discipline

- Establishing clear risk management rules and sticking to them can help traders maintain emotional control.

- Regularly assessing risk tolerance and adjusting leverage levels accordingly can prevent emotional decision-making.

- Practicing mindfulness techniques and taking breaks from trading can help manage stress and emotions related to leverage.

Psychological Impact on Risk Tolerance and Trading Strategies

- Leverage can influence a trader’s risk tolerance, with some becoming more risk-averse and others more risk-seeking due to the amplified stakes.

- Traders may need to adapt their trading strategies when using leverage to account for increased volatility and potential losses.

- Understanding the psychological impact of leverage can help traders make more informed decisions and avoid emotional pitfalls.

In conclusion, mastering the art of controlling risk with leverage in forex can lead to more disciplined and profitable trading. Implementing the right strategies and tools can make all the difference in your trading journey.

In volatile markets, having a solid forex strategy is essential to navigate sudden price fluctuations. Techniques such as using stop-loss orders, diversifying your portfolio, and staying updated on market trends can help traders manage risks effectively.

Managing risk is a key aspect of successful forex trading. Learning how to manage risk involves setting stop-loss orders, calculating position sizes based on risk tolerance, and avoiding emotional decision-making during trades.