Correlation between currencies in forex is a crucial aspect of trading that impacts decision-making. From defining currency correlation to exploring its types and factors, this article delves into the complexities of this concept, offering valuable insights for traders.

Exploring various tools and techniques for analyzing currency correlations, this comprehensive guide equips traders with the knowledge needed to navigate the forex market successfully.

Introduction to Currency Correlation in Forex: Correlation Between Currencies In Forex

Currency correlation in forex trading refers to how different currency pairs move in relation to each other. It helps traders understand the interconnectedness between various currencies and how they influence each other’s movements in the market.

Understanding currency correlation is essential for traders as it can help them diversify their portfolios, manage risk, and make more informed trading decisions. By knowing how currency pairs are correlated, traders can anticipate potential movements in the market and adjust their strategies accordingly.

Examples of currency correlation in the forex market include:

– Positive correlation: When two currency pairs move in the same direction. For example, EUR/USD and GBP/USD tend to have a positive correlation as they both generally move in the same direction.

– Negative correlation: When two currency pairs move in opposite directions. For instance, USD/JPY and USD/CHF typically exhibit a negative correlation as they tend to move in opposite directions.

– No correlation: Some currency pairs may not have a clear relationship or correlation with each other. For example, EUR/USD and USD/JPY may not show a strong correlation at times.

Understanding these correlations can help traders make more informed decisions and better navigate the complexities of the forex market.

Types of Currency Correlations

When it comes to currency correlations in forex trading, there are three main types: positive correlation, negative correlation, and no correlation. Understanding these correlations is crucial for devising effective trading strategies and managing risk.

Positive Correlation

Positive correlation occurs when two currency pairs move in the same direction. This means that when one currency pair strengthens, the other pair also strengthens, and vice versa. Traders often use positively correlated pairs to diversify their portfolios and hedge against risk.

- Example: EUR/USD and GBP/USD are known to have a positive correlation. When the EUR/USD pair goes up, the GBP/USD pair also tends to rise.

Negative Correlation

Negative correlation, on the other hand, occurs when two currency pairs move in opposite directions. This means that when one pair strengthens, the other pair weakens, and vice versa. Traders can use negatively correlated pairs to hedge against risk and potentially increase profits.

- Example: USD/JPY and EUR/USD are known to have a negative correlation. When the USD/JPY pair goes up, the EUR/USD pair tends to decrease.

No Correlation

No correlation means that there is no discernible relationship between the movements of two currency pairs. This type of correlation is less common but still important to consider when developing trading strategies.

- Example: USD/CHF and AUD/JPY are often considered to have no correlation. The movements of these pairs do not have a significant impact on each other.

Factors Influencing Currency Correlations

Understanding the factors that influence currency correlations in forex trading is crucial for traders to make informed decisions. Various elements can impact the relationship between different currency pairs, affecting market movements and trading strategies.

Economic Indicators

Economic indicators, such as GDP growth, inflation rates, employment data, and trade balances, play a significant role in determining currency correlations. Strong economic data in one country compared to another can lead to a higher correlation between their respective currencies.

Geopolitical Events, Correlation between currencies in forex

Geopolitical events like elections, wars, and trade disputes can introduce volatility in the forex market, impacting currency correlations. Uncertainty surrounding these events can cause fluctuations in currency pairs and alter their relationships with other currencies.

Market Sentiment

Market sentiment, including risk appetite and investor confidence, can influence currency correlations. Positive sentiment towards a particular currency can strengthen its correlation with other currencies, while negative sentiment can lead to a negative correlation.

Central Bank Policies

Central bank policies, such as interest rate decisions, monetary policy statements, and quantitative easing programs, can have a profound impact on currency correlations. Divergent monetary policies between countries can result in contrasting correlations between their currencies.

Tools and Techniques for Analyzing Currency Correlations

Currency correlation analysis in forex trading is essential for understanding the relationships between different currency pairs and how they may impact each other. There are various tools and techniques available to help traders analyze currency correlations effectively and make informed trading decisions.

Correlation Coefficients

Correlation coefficients are numerical measures that indicate the strength and direction of a relationship between two variables. In the context of forex trading, correlation coefficients are commonly used to quantify the relationship between different currency pairs. A correlation coefficient close to +1 indicates a strong positive correlation, while a coefficient close to -1 indicates a strong negative correlation. Traders can use correlation coefficients to identify pairs that move in the same direction, pairs that move in opposite directions, or pairs that have no relationship at all.

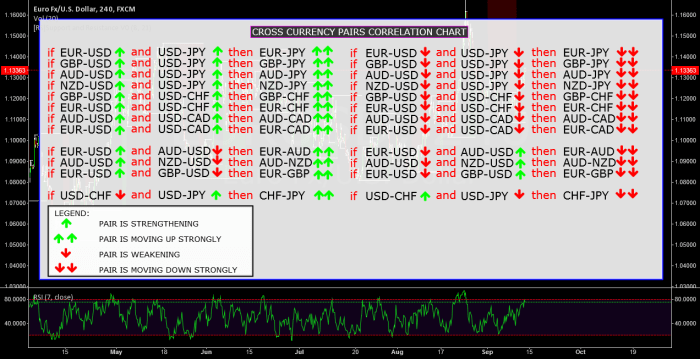

Charts

Charts are visual tools that traders can use to analyze currency correlations over time. By plotting the price movements of multiple currency pairs on a chart, traders can easily identify patterns and trends in their correlations. Line charts, bar charts, and candlestick charts are commonly used to visualize currency correlations and identify potential trading opportunities. Traders can also use technical indicators and overlays on charts to further enhance their analysis of currency correlations.

Software

There are several software programs available that can help traders analyze currency correlations more efficiently. These software programs often provide advanced tools and features for calculating correlation coefficients, generating correlation matrices, and visualizing correlations on charts. Some software programs also offer automated trading strategies based on currency correlations, allowing traders to execute trades more effectively. By using software tools, traders can streamline their analysis of currency correlations and make quicker decisions in the fast-paced forex market.

Traders can leverage these tools and techniques to gain valuable insights into currency correlations and improve their trading strategies. By understanding how different currency pairs move in relation to each other, traders can make more informed decisions about when to enter or exit trades, manage risk effectively, and capitalize on profitable opportunities in the forex market.

In conclusion, understanding currency correlations in forex is essential for devising effective trading strategies and making informed decisions. By considering the factors influencing correlations and utilizing the right tools, traders can enhance their trading outcomes and achieve greater success in the forex market.

When it comes to forex trading, understanding fundamental analysis is crucial for making informed decisions. By analyzing economic indicators, interest rates, and geopolitical events, traders can predict currency movements and make profitable trades. Check out this detailed guide on fundamental analysis for forex trading to enhance your trading skills.

To be successful in forex trading, it is essential to analyze trends effectively. By studying charts, patterns, and market behavior, traders can identify potential entry and exit points. Learn how to interpret forex trends accurately by reading this insightful article on analyzing forex trends effectively and stay ahead of the game.

The importance of economic data in forex trading cannot be overlooked. Economic reports such as GDP, employment figures, and inflation rates have a significant impact on currency values. Stay informed about the latest economic data and its implications on the forex market by visiting this informative link on the importance of economic data in forex.