Duration and risk in bond investing sets the stage for a deep dive into the world of bonds, shedding light on the intricate connection between duration and risk that every investor should grasp.

As we unravel the complexities of bond investing, we explore the nuances of duration and risk, offering insights that can shape your investment decisions in profound ways.

Duration in Bond Investing: Duration And Risk In Bond Investing

Duration in bond investing refers to the measure of a bond’s price sensitivity to interest rate changes. It helps investors understand how much the price of a bond is likely to change in response to a change in interest rates.

Calculation of Duration

Duration is calculated by taking the weighted average of the times to receive the bond’s cash flows, with the weights representing the present value of each cash flow. The formula for duration is represented as:

Duration = Σ (t * CFt) / P

Where:

– t = time to receive the cash flow

– CFt = cash flow at time t

– P = current price of the bond

Examples of Bond Durations

- Short-Term Bonds: Short-term bonds typically have durations of 1 to 3 years. These bonds are less sensitive to interest rate changes compared to long-term bonds.

- Medium-Term Bonds: Medium-term bonds have durations ranging from 4 to 7 years. They offer a balance between risk and return for investors.

- Long-Term Bonds: Long-term bonds have durations of 8 years or more. These bonds are more sensitive to interest rate changes and carry higher risk.

Risk in Bond Investing

:max_bytes(150000):strip_icc()/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png?w=700)

When it comes to bond investing, understanding and managing risks is crucial for investors to make informed decisions. Risk in bond investments refers to the possibility of losing money or not achieving expected returns due to various factors impacting the bond’s value.

Types of Risks in Bond Investing

- Interest Rate Risk: This risk arises from changes in interest rates affecting the bond’s value. When interest rates rise, bond prices typically fall, and vice versa.

- Credit Risk: Also known as default risk, credit risk is the risk of the bond issuer failing to make interest payments or repay the principal amount.

- Reinvestment Risk: This risk occurs when cash flows from a bond investment need to be reinvested at lower interest rates than the original investment.

- Liquidity Risk: Liquidity risk refers to the difficulty of selling a bond quickly without significantly impacting its price.

- Inflation Risk: Inflation risk is the risk that inflation will erode the purchasing power of the bond’s future cash flows.

Strategies to Manage Risks in Bond Investing, Duration and risk in bond investing

- Diversification: By investing in a variety of bonds with different risk profiles, investors can reduce their overall risk exposure.

- Duration Matching: Matching the duration of bonds with the investor’s time horizon can help mitigate interest rate risk.

- Credit Analysis: Conducting thorough research on bond issuers to assess their creditworthiness can help manage credit risk.

- Monitoring Market Conditions: Keeping track of economic indicators and market trends can help investors make timely decisions to mitigate various risks.

Relationship Between Duration and Risk

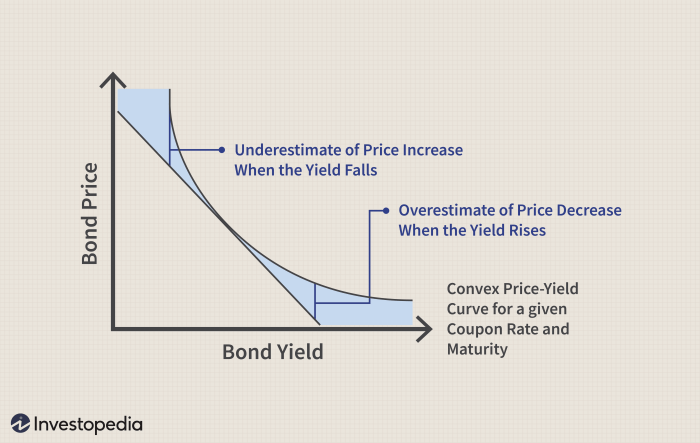

When it comes to bond investing, the relationship between duration and risk is crucial for investors to understand. Duration not only measures the sensitivity of a bond’s price to interest rate changes but also plays a significant role in determining the level of risk associated with a bond investment.

Duration Risk and Its Implications

Duration risk, also known as interest rate risk, refers to the potential impact of changes in interest rates on a bond’s value. Bonds with longer durations are more sensitive to interest rate fluctuations, making them riskier investments compared to bonds with shorter durations. Investors who hold bonds with higher durations may face greater price volatility and potential losses if interest rates rise.

- Longer duration bonds have higher duration risk: Bonds with longer durations have a higher sensitivity to changes in interest rates. This means that as interest rates increase, the value of these bonds will decrease at a faster rate compared to bonds with shorter durations.

- Shorter duration bonds offer lower risk: Bonds with shorter durations are less impacted by changes in interest rates, resulting in lower duration risk. While these bonds may offer lower returns, they provide more stability and protection against interest rate fluctuations.

Investors need to consider the relationship between duration and risk when building a diversified bond portfolio to manage potential fluctuations in market conditions.

Importance of Understanding Duration and Risk

Investors must grasp the relationship between duration and risk to make informed decisions and manage their bond portfolios effectively. Duration measures a bond’s sensitivity to interest rate changes, while risk reflects the potential for loss. Understanding how these factors interact is crucial for optimizing investment strategies.

Impact on Investment Decisions

- A deep understanding of duration and risk allows investors to assess the potential impact of interest rate fluctuations on their bond holdings.

- By considering both duration and risk, investors can construct a well-diversified portfolio that balances risk and return based on their investment goals and risk tolerance.

- Knowledge of duration and risk also helps investors identify opportunities to capitalize on market inefficiencies and adjust their portfolios accordingly.

Real-Life Scenarios

- In a rising interest rate environment, investors with a solid understanding of duration and risk may choose to invest in short-duration bonds to minimize losses due to interest rate sensitivity.

- Conversely, in a declining interest rate environment, investors may opt for longer-duration bonds to take advantage of potential price appreciation.

- Successful investors often attribute their profitable strategies to their ability to navigate the complex relationship between duration and risk in bond investing.

In conclusion, understanding the dynamics of duration and risk in bond investing is not just a choice but a necessity for successful investment strategies. Let this knowledge guide you towards informed decisions and lucrative opportunities in the realm of bonds.

When it comes to investing, many people overlook the benefits of investing in bonds. Bonds offer a fixed income stream, lower risk compared to stocks, and can provide diversification to a portfolio. Learn more about the benefits of investing in bonds to make informed investment decisions.

Debating between bonds and stocks? It’s essential to understand the differences between the two before making a decision. While stocks offer higher potential returns, bonds are known for their stability and income generation. Discover which option is better for you in the bonds vs stocks: which is better guide.

For conservative investors looking for safe investment options, bonds can be an excellent choice. Safe bonds provide steady income and lower volatility, making them a reliable option for risk-averse individuals. Explore the best options for conservative investors in the safe bonds for conservative investors article.