Beginning with forex breakout trading strategy, the narrative unfolds in a compelling and distinctive manner, drawing readers into a story that promises to be both engaging and uniquely memorable.

Forex breakout trading strategy involves identifying key breakout opportunities in the forex market, utilizing technical indicators, and managing risk effectively to maximize profits. This article delves into the essential aspects of this strategy, providing insights and examples for traders looking to enhance their trading game.

Introduction to Forex Breakout Trading Strategy

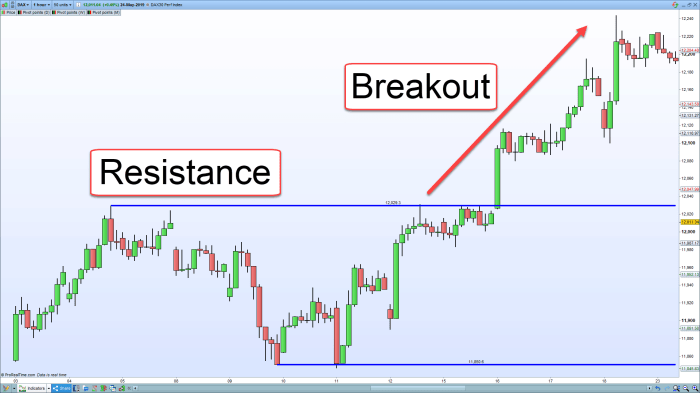

Forex breakout trading strategy involves identifying key levels of support and resistance in the forex market and placing trades when the price breaks out of these levels. This strategy aims to capitalize on significant price movements that occur after a breakout, potentially leading to profitable trades.

Key Principles of Breakout Trading

Breakout trading is based on the following key principles:

- Identifying key support and resistance levels: Traders analyze price charts to identify levels where the price has previously struggled to break through.

- Waiting for a breakout: Traders wait for the price to break above resistance or below support before entering a trade.

- Volume confirmation: Traders look for increased trading volume to confirm the breakout and validate the strength of the move.

- Setting stop-loss and take-profit levels: Traders use stop-loss orders to limit potential losses and take-profit orders to lock in profits.

Examples of Successful Breakout Trading Strategies in Forex Markets

Successful breakout trading strategies in forex markets often involve trading major currency pairs like EUR/USD, GBP/USD, and USD/JPY. Traders may use technical analysis tools such as Bollinger Bands, moving averages, and Fibonacci retracement levels to identify potential breakout opportunities.

When it comes to navigating the complex world of forex trading, having a solid understanding of forex technical analysis strategies is crucial. By utilizing tools like charts and indicators, traders can make informed decisions based on market trends and patterns.

Identifying Breakout Opportunities

When it comes to forex trading, identifying breakout opportunities is crucial for traders looking to capitalize on market movements. Breakouts occur when the price of a currency pair moves beyond a certain level, indicating a potential shift in market sentiment.

While technical analysis focuses on historical price movements, technical vs fundamental analysis in forex debates the importance of economic factors. Understanding both approaches can help traders develop a comprehensive trading strategy.

Importance of Volume and Volatility, Forex breakout trading strategy

In order to identify breakout opportunities, traders often look at two key factors: volume and volatility. Volume refers to the number of trades being executed, while volatility measures the size of price fluctuations. High volume and volatility often precede breakouts, signaling increased interest and potential for significant price movements.

- High volume: A surge in trading volume can indicate strong market participation and conviction, increasing the likelihood of a breakout.

- Increased volatility: Rising volatility suggests that market conditions are changing, potentially leading to breakouts as traders adjust their positions.

Common Technical Indicators

Traders often use technical indicators to confirm breakout signals and strengthen their trading decisions. These indicators can help traders validate potential breakouts and avoid false signals.

Delving into the realm of market psychology, forex sentiment analysis explained explores how trader emotions impact price movements. By gauging market sentiment, traders can anticipate potential market shifts.

| Indicator | Description |

|---|---|

| Relative Strength Index (RSI) | A momentum oscillator that measures the speed and change of price movements. An RSI above 70 indicates overbought conditions, while an RSI below 30 suggests oversold conditions. |

| Bollinger Bands | A volatility indicator that consists of a simple moving average and two standard deviation bands. Breakouts often occur when the price moves beyond the bands. |

| Moving Average Convergence Divergence (MACD) | A trend-following momentum indicator that shows the relationship between two moving averages. A bullish crossover indicates a potential breakout to the upside, while a bearish crossover suggests a downside breakout. |

Entry and Exit Points in Breakout Trading

When it comes to breakout trading, determining the right entry and exit points is crucial for maximizing profits and minimizing losses. Traders need to carefully identify key levels and price points to enter and exit trades effectively.

Entry Points in Breakout Trading

In breakout trading, traders typically look for price levels where the asset breaks out of a defined range or pattern. This could be a resistance level that has been broken to the upside or a support level that has been broken to the downside. One common approach is to enter a trade as soon as the breakout occurs, with the expectation that the price will continue to move in the direction of the breakout.

- Traders can use technical indicators such as moving averages, Bollinger Bands, or Fibonacci retracement levels to confirm the breakout and identify potential entry points.

- Another strategy is to wait for a retest of the breakout level before entering a trade, as this can provide additional confirmation that the breakout is valid.

Stop-Loss Orders in Breakout Trading

Stop-loss orders are essential in breakout trading to manage risk and protect capital. Traders should set stop-loss orders at key levels to limit potential losses if the trade goes against them. By defining the maximum acceptable loss upfront, traders can avoid emotional decision-making and stick to their trading plan.

- Traders can set stop-loss orders below the breakout level for long trades and above the breakout level for short trades to minimize losses in case of a reversal.

- Using a trailing stop-loss strategy can also be effective in breakout trading, allowing traders to lock in profits as the price moves in their favor.

Setting Profit Targets in Breakout Trading

Determining profit targets is equally important in breakout trading to capture gains and exit trades at the right time. Traders can use various strategies to set profit targets based on the potential price movement and risk-reward ratio.

- One approach is to set a profit target based on the width of the breakout pattern or range, projecting a similar price move in the direction of the breakout.

- Traders can also use support and resistance levels, trendlines, or Fibonacci extension levels to identify potential profit targets and exit points.

Risk Management in Forex Breakout Trading

Effective risk management is crucial when implementing a breakout trading strategy in the forex market. By carefully managing your risk exposure, you can protect your trading capital and maximize your potential returns. In breakout trading, where prices can be highly volatile, risk management becomes even more important to ensure long-term success.

Use of Position Sizing and Leverage

In breakout trading, position sizing and leverage play a significant role in managing risk. Position sizing involves determining the amount of capital to risk on each trade based on the size of your trading account and the level of risk you are willing to take. By properly sizing your positions, you can limit potential losses and protect your account from large drawdowns.

Leverage, on the other hand, can amplify both profits and losses in breakout trading. While leverage allows traders to control larger positions with a smaller amount of capital, it also increases the risk of significant losses if the market moves against your position. It is essential to use leverage cautiously and in conjunction with proper risk management techniques to avoid excessive risk exposure.

Risk Management Techniques in Breakout Trading

1. Set Stop Loss Orders: Place stop-loss orders at strategic levels to limit your losses if the breakout trade does not go as planned. This ensures that you exit the trade before significant losses occur.

2. Use Trailing Stops: Trailing stops can be employed to lock in profits as the trade moves in your favor. This allows you to protect your gains while giving the trade room to develop further.

3. Diversify Your Trades: Avoid putting all your capital into a single breakout trade. Diversifying your trades across different currency pairs or asset classes can help spread risk and reduce the impact of potential losses.

4. Monitor Risk-to-Reward Ratio: Assess the potential reward relative to the risk involved in each breakout trade. Aim for a favorable risk-to-reward ratio to ensure that your potential profits outweigh your potential losses.

By incorporating these risk management techniques into your breakout trading strategy, you can effectively navigate the volatile forex market and safeguard your trading capital.

In conclusion, mastering the forex breakout trading strategy requires a blend of analytical skills, risk management, and a keen understanding of market dynamics. By implementing the principles Artikeld in this guide, traders can potentially improve their trading outcomes and achieve greater success in the competitive forex market.