Delving into forex strategy for volatile markets, this introduction immerses readers in a unique and compelling narrative, with a focus on the crucial elements that traders need to navigate turbulent market conditions effectively. From risk management to technical analysis tools, this guide explores the strategies needed to thrive in volatile forex markets.

As we delve deeper into the key components of a successful forex strategy for volatile markets, it becomes evident that adaptability and flexibility are key factors in ensuring success. By understanding the nuances of technical and fundamental analysis, traders can capitalize on market volatility and make informed decisions.

Introduction to Forex Trading in Volatile Markets

In the world of forex trading, volatile markets refer to periods of sharp and unpredictable price movements. These fluctuations can be caused by various factors such as economic news, geopolitical events, or market sentiment.

Having a solid strategy is crucial during market volatility as it can help traders navigate through the uncertainty and make informed decisions. Without a strategy, traders may succumb to emotional trading, leading to impulsive and irrational decisions that can result in significant losses.

Unique Challenges and Opportunities in Volatile Markets

- Increased risk: Volatile markets can lead to higher levels of risk due to the rapid price movements. Traders need to be prepared for sudden changes and potential losses.

- Enhanced profit potential: On the flip side, volatile markets also present opportunities for traders to capitalize on significant price swings and potentially earn higher profits.

- Liquidity issues: During periods of extreme volatility, liquidity in the market may dry up, making it harder for traders to execute trades at desired prices.

- Adaptability is key: Traders need to be adaptable and flexible in their approach to trading in volatile markets. Strategies may need to be adjusted quickly to respond to changing market conditions.

Key Elements of a Forex Strategy for Volatile Markets

When trading in volatile markets, it is crucial to have a well-thought-out forex strategy that can help navigate the uncertainties and risks associated with sudden price movements. A successful forex strategy in such conditions should encompass key elements to ensure profitability and risk mitigation.

For those looking to take a longer-term approach to forex trading, position trading in forex may be the way to go. This strategy involves holding positions for extended periods, often weeks or months, to capitalize on major market trends. It requires patience and discipline, but can be highly rewarding for those who master it.

Components of a Successful Forex Strategy in Volatile Conditions

- Technical Analysis: Utilizing technical indicators and chart patterns to identify potential entry and exit points based on historical price movements.

- Fundamental Analysis: Considering economic indicators, political events, and market sentiment to anticipate market reactions and make informed trading decisions.

- Risk Management: Implementing proper risk management techniques, such as setting stop-loss orders and position sizing, to protect capital and minimize losses.

- Adaptability: Being flexible and adjusting the strategy based on changing market conditions to capitalize on opportunities and mitigate risks.

Role of Risk Management in Forex Strategies for Volatile Markets

Risk management is a critical component of any forex strategy, especially in volatile markets where price fluctuations can be unpredictable and extreme. By effectively managing risk, traders can protect their capital and avoid significant losses that could jeopardize their trading accounts.

Understanding forex candlestick patterns is essential for any trader looking to make informed decisions. These patterns provide valuable insights into market sentiment and potential price movements. By recognizing and interpreting these patterns, traders can gain an edge in the market and improve their trading results.

Importance of Clear Entry and Exit Strategy in Volatile Market Conditions, Forex strategy for volatile markets

Having a clear entry and exit strategy is essential in volatile market conditions to capitalize on price movements and minimize exposure to risk. A well-defined plan for entering and exiting trades helps traders make informed decisions based on predetermined criteria, removing emotional bias and increasing the chances of success.

When it comes to forex trading, many traders rely heavily on indicators to make decisions. However, there is a growing trend towards adopting a forex trading strategy without indicators. By focusing on price action and market dynamics, traders aim to improve their decision-making process and overall profitability.

Technical Analysis Tools for Volatile Markets

In volatile markets, technical analysis tools play a crucial role in helping traders make informed decisions and navigate the ups and downs of price movements. These tools can provide valuable insights into market trends, potential entry and exit points, and overall market sentiment.

Moving Averages

Moving averages are commonly used technical indicators that help smooth out price data over a specific period, making it easier to identify trends. In volatile markets, traders can use moving averages to filter out noise and focus on the underlying trend. For example, a trader might look for a crossover between a short-term moving average and a long-term moving average as a signal to enter or exit a trade.

Bollinger Bands

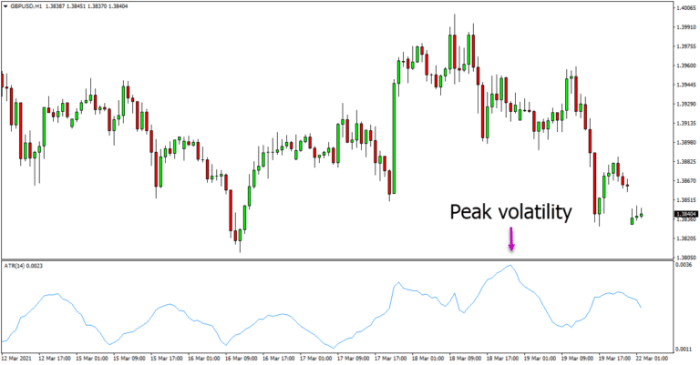

Bollinger Bands consist of a simple moving average and two standard deviations plotted above and below the moving average. These bands expand and contract based on market volatility, making them particularly useful in volatile conditions. Traders can use Bollinger Bands to identify overbought or oversold conditions and potential reversal points in the market.

Relative Strength Index (RSI)

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. In volatile markets, RSI can help traders identify potential trend reversals or overbought/oversold conditions. For example, a trader might look for divergence between the RSI and price action as a signal that the current trend is weakening.

Overall, these technical analysis tools can provide traders with valuable insights and signals to navigate volatile markets effectively and make informed trading decisions.

Fundamental Analysis and News Trading in Volatile Markets

When trading in volatile markets, fundamental analysis plays a crucial role in crafting a successful forex strategy. Fundamental analysis involves evaluating economic indicators, geopolitical events, and other factors that can impact currency values.

Impact of News Events on Market Volatility

News events have a significant impact on market volatility in the forex market. Events such as economic data releases, central bank announcements, geopolitical tensions, and natural disasters can cause sudden price movements in currency pairs.

- Traders can capitalize on news events by staying informed and reacting quickly to market developments.

- It is essential to have a well-defined risk management strategy in place to protect against unexpected price fluctuations.

- News trading requires a high level of discipline and the ability to make quick decisions based on new information.

Incorporating Economic Calendar Events into Trading Strategy

One way to navigate volatile market conditions is to incorporate economic calendar events into your trading strategy. Economic calendars provide a schedule of upcoming economic releases and events that could impact currency prices.

- Traders should pay close attention to high-impact economic indicators such as non-farm payrolls, GDP reports, and interest rate decisions.

- By planning ahead and anticipating market reactions to economic data, traders can position themselves to take advantage of potential trading opportunities.

- It is essential to be aware of the timing of economic releases and to adjust trading strategies accordingly to minimize risk.

Adaptation and Flexibility in Forex Strategies

In the volatile forex market, it is crucial for traders to be adaptable and flexible in their approach. Market conditions can change rapidly, and successful traders must be able to pivot their strategies accordingly.

Importance of Adaptability

Adaptability is key when trading in volatile markets. Traders need to be able to quickly adjust their strategies in response to sudden spikes in volatility. This may involve changing entry and exit points, risk management techniques, or even the overall trading plan.

Pivoting Strategies During Volatility

- Monitor market indicators closely: Keep a close eye on technical indicators, such as moving averages and oscillators, to identify potential entry and exit points.

- Use trailing stop losses: Implementing trailing stop losses can help protect profits and limit losses during volatile market conditions.

- Consider shorter timeframes: In highly volatile markets, trading on shorter timeframes can help capture quick price movements and minimize exposure to risk.

- Diversify trading instruments: Diversifying your portfolio by trading different currency pairs can help spread risk and take advantage of varying volatility levels.

Backtesting and Refining Strategies

Backtesting is a crucial step in refining forex strategies for volatile markets. By testing strategies against historical data, traders can identify strengths and weaknesses and make necessary adjustments to improve performance. It is essential to continuously refine and adapt strategies based on market conditions and feedback from backtesting results.

In conclusion, the world of forex trading in volatile markets presents both challenges and opportunities. By honing your strategy, staying informed about market events, and maintaining flexibility in your approach, you can position yourself for success even in the most turbulent conditions.