How to hedge against inflation with commodities sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with semrush author style and brimming with originality from the outset.

Inflation can have a significant impact on purchasing power, but commodities offer a viable solution to hedge against this economic threat. Let’s delve into the world of commodities and explore how they can serve as a shield against inflationary pressures.

Understanding Inflation and Commodities: How To Hedge Against Inflation With Commodities

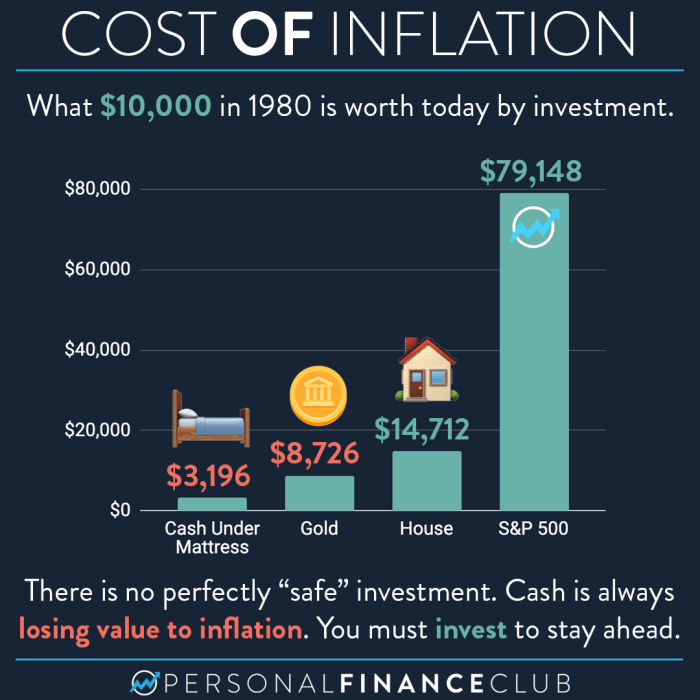

Inflation is the gradual increase in the prices of goods and services in an economy, leading to a decrease in the purchasing power of a currency. This means that over time, the same amount of money will buy fewer goods and services than it did before. Inflation erodes the value of money and can have a significant impact on individuals, investors, and businesses.

Commodities are raw materials or primary agricultural products that can be bought and sold. They are tangible assets that have intrinsic value and are used in the production of goods and services. Commodities can act as a hedge against inflation because their prices tend to rise when inflation is high. This is because the cost of producing these commodities increases with inflation, leading to higher prices in the market.

Examples of Commonly Used Commodities for Hedging Purposes

- Gold: Gold is often seen as a safe haven asset during times of economic uncertainty and inflation. Its value tends to increase when inflation rises, making it a popular choice for investors looking to hedge against inflation.

- Oil: Oil is a crucial commodity that is used in various industries, including transportation and manufacturing. Its price is closely linked to inflation, as higher inflation tends to drive up the cost of oil production and transportation.

- Agricultural products: Commodities like wheat, corn, and soybeans are essential for food production and are influenced by inflation. When inflation rises, the prices of agricultural products also tend to increase, making them attractive assets for hedging against inflation.

Types of Commodities for Inflation Hedging

When it comes to hedging against inflation, commodities can play a crucial role in preserving the value of investments. Understanding the types of commodities available for this purpose is essential for investors looking to protect their portfolios.

Hard vs. Soft Commodities

Hard commodities refer to natural resources that are mined or extracted, such as metals and energy products. These commodities are tangible and have intrinsic value. Soft commodities, on the other hand, include agricultural products like grains, livestock, and other raw materials. Both hard and soft commodities can serve as effective inflation hedges, albeit in different ways.

-

- Hard Commodities: Precious Metals

Precious metals like gold and silver are often considered traditional safe-haven assets during times of economic uncertainty. These metals have historically retained their value over the long term, making them popular choices for investors looking to hedge against inflation. The limited supply of precious metals and their status as stores of value make them attractive options for preserving wealth.

-

- Soft Commodities: Agricultural Products

Agricultural commodities, including grains like corn, wheat, and soybeans, can also act as inflation hedges. Demand for these essential goods tends to remain relatively stable, making them less susceptible to economic downturns. Additionally, agricultural commodities have a low correlation with traditional asset classes, providing diversification benefits to investors seeking to mitigate risk in their portfolios.

Factors Influencing Commodities in Inflation Hedging

Inflation hedging with commodities involves understanding various factors that can influence commodity prices during inflationary periods. These factors play a crucial role in determining the effectiveness of using commodities as a hedge against inflation.

Relationship Between Interest Rates and Commodity Prices

Interest rates have a significant impact on commodity prices. In general, when interest rates are low, investors tend to move towards commodities as an alternative investment, driving up demand and prices. Conversely, higher interest rates can lead to decreased demand for commodities as investors may opt for other investment opportunities that offer better returns.

Supply and Demand Dynamics, How to hedge against inflation with commodities

Supply and demand dynamics play a vital role in influencing commodity values during inflation. In times of inflation, demand for certain commodities may increase as investors seek to protect the value of their assets. This increased demand can drive up prices, especially for essential commodities like precious metals or agricultural products. On the other hand, disruptions in the supply chain can lead to supply shortages, further exacerbating price increases.

Geopolitical Factors Impacting Commodity Markets

Geopolitical factors such as trade agreements, political instability, and natural disasters can have a significant impact on commodity markets. These factors can disrupt the supply of commodities, leading to price fluctuations. Investors need to monitor geopolitical events closely to identify potential risks and opportunities for hedging strategies. For example, conflicts in major oil-producing regions can lead to supply disruptions and impact oil prices, making it essential for investors to consider geopolitical factors when hedging against inflation with commodities.

Implementing Inflation Hedging Strategies with Commodities

Investors often turn to commodities as a way to protect their portfolios from the erosive effects of inflation. By diversifying their investments with commodities, they can mitigate the risks associated with rising prices and preserve the real value of their assets.

Comparison of Investment Vehicles for Inflation Protection

- Futures: Investing in commodity futures allows investors to speculate on the future price movements of commodities without owning the physical assets. It provides a high degree of leverage but also comes with significant risks.

- ETFs: Exchange-traded funds (ETFs) offer a more accessible way to invest in commodities without having to deal with the complexities of futures trading. They provide diversification and liquidity to investors.

- Physical Assets: Owning physical commodities such as gold, silver, or agricultural products can provide a hedge against inflation by holding tangible assets with intrinsic value.

Tips for Monitoring and Adjusting Commodity Investments

- Stay Informed: Keep track of inflation indicators such as the Consumer Price Index (CPI) and Producer Price Index (PPI) to gauge the impact of inflation on commodity prices.

- Diversify: Spread your investments across different commodities to reduce risk and exposure to any single asset class.

- Rebalance: Regularly review your commodity investments and adjust your portfolio to reflect changes in inflation expectations and market conditions.

As we wrap up our discussion on hedging against inflation with commodities, it becomes evident that these assets play a crucial role in protecting portfolios during turbulent economic times. By understanding the various types of commodities, factors influencing their value, and practical strategies for implementation, investors can navigate the challenges of inflation with confidence and resilience.

When it comes to investing in real estate, one common debate is between commercial real estate vs residential real estate. Both sectors have their own advantages and disadvantages. Commercial properties typically offer higher rental income and longer leases, while residential properties may be easier to manage. To make an informed decision, it’s important to understand the differences between the two.

You can read more about the comparison between commercial real estate and residential real estate to help you decide which type of property suits your investment goals.

For investors looking to capitalize on the real estate market in 2024, it’s crucial to know the best real estate markets to consider. Factors such as job growth, population trends, and affordability play a significant role in determining the top markets. By staying informed about the latest trends and forecasts, you can make strategic investment decisions. Check out the list of the best real estate markets for 2024 to stay ahead of the game in the competitive real estate industry.

When diversifying your investment portfolio, commodities can be a lucrative option. However, choosing the right commodities to invest in is crucial for success. Factors such as supply and demand, geopolitical events, and market trends can impact commodity prices. To make informed investment decisions, it’s essential to stay updated on the best commodities to invest in. Explore the top picks for best commodities to invest in and maximize your investment potential.