Kicking off with swing trading forex strategies, this opening paragraph is designed to captivate and engage the readers, setting the tone semrush author style that unfolds with each word.

Swing trading in the forex market involves strategic moves to capitalize on market fluctuations, offering traders the potential for significant returns. With a focus on precise entry and exit points, these strategies aim to optimize profits while managing risks effectively. In this comprehensive guide, we delve into the world of swing trading forex strategies, exploring key principles, essential tools, and popular strategies that can help traders navigate the dynamic forex market with confidence.

Overview of Swing Trading Forex Strategies

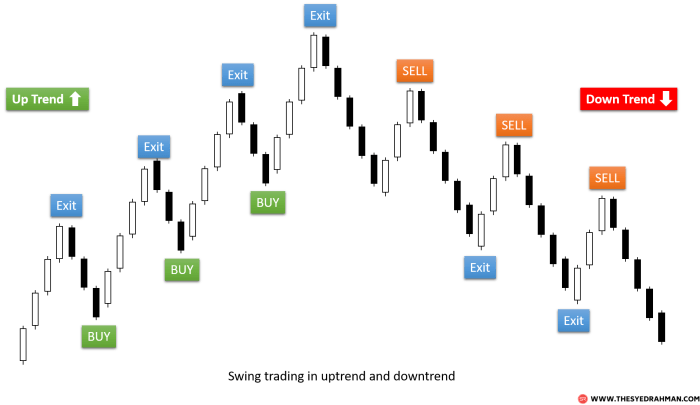

Swing trading in the context of forex trading involves making trades based on short to medium-term price movements, typically holding positions for a few days to a few weeks. Unlike day trading, swing trading allows traders to take advantage of market fluctuations without the need to constantly monitor the markets.

When starting out in forex trading, it’s essential to use the best forex indicators for beginners to make informed decisions. These indicators help identify trends and potential entry and exit points, making it easier for newcomers to navigate the market.

One of the key benefits of using swing trading strategies in forex is the potential for higher profits compared to long-term investing or day trading. Swing traders aim to capture price movements within a trend, maximizing gains while minimizing risks.

One key aspect of successful forex trading is analyzing forex trends effectively. By understanding market trends, traders can anticipate price movements and adjust their strategies accordingly, increasing their chances of making profitable trades.

Key Principles of Swing Trading in the Forex Market

- Identifying trends: Swing traders focus on recognizing trends in the forex market and entering positions in the direction of the prevailing trend.

- Setting stop-loss orders: Managing risk is crucial in swing trading, and setting stop-loss orders helps limit potential losses in case the trade moves against the trader.

- Using technical analysis: Swing traders often rely on technical indicators and chart patterns to identify entry and exit points for their trades.

- Patience and discipline: Successful swing trading requires patience to wait for the right opportunities and discipline to stick to a trading plan.

Essential Tools for Swing Trading Forex Strategies

Swing trading in forex requires the use of various technical analysis tools to identify potential entry and exit points in the market. These tools help traders make informed decisions based on market trends, price movements, and other factors.

Technical Analysis Tools

- Moving Averages: Moving averages are used to smooth out price data and identify trends. Traders often look for crossover points between different moving averages to signal potential buy or sell opportunities.

- Relative Strength Index (RSI): RSI is a momentum oscillator that measures the speed and change of price movements. Traders use RSI to identify overbought or oversold conditions in the market.

- Moving Average Convergence Divergence (MACD): MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. Traders use MACD to identify changes in the strength, direction, momentum, and duration of a trend.

- Bollinger Bands: Bollinger Bands consist of a middle band (simple moving average) and two outer bands (standard deviations away from the middle band). Traders use Bollinger Bands to identify potential overbought or oversold conditions and volatility in the market.

Chart Patterns and Trendlines

- Chart Patterns: Chart patterns, such as head and shoulders, triangles, flags, and pennants, can help traders identify potential trend reversals or continuations. Traders often use these patterns in combination with other technical analysis tools for confirmation.

- Trendlines: Trendlines are used to identify the direction of the trend in the market. Traders draw trendlines connecting swing lows or highs to determine the overall trend. Trendlines can also act as support and resistance levels for price movements.

Developing a Swing Trading Plan

Developing a swing trading plan is crucial for success in the forex market. It involves creating a personalized strategy that aligns with your risk tolerance, financial goals, and trading style. Here are the steps involved in creating a swing trading plan:

Integration of Risk Management Techniques

Risk management is a key component of any trading plan, as it helps protect your capital and minimize losses. When developing a swing trading plan, it is essential to integrate risk management techniques such as setting stop-loss orders and position sizing. By defining your risk tolerance and implementing risk management strategies, you can ensure that your trading plan is sustainable in the long run.

Example of Entry and Exit Points, Swing trading forex strategies

Entry and exit points are crucial aspects of a swing trading plan. For example, you may decide to enter a trade when a stock breaks out of a key resistance level, indicating a potential uptrend. On the other hand, you may choose to exit a trade when the price reaches a certain profit target or when the market conditions change. By identifying clear entry and exit points, you can make informed trading decisions and maximize your profits while minimizing losses.

Popular Swing Trading Strategies in Forex: Swing Trading Forex Strategies

When it comes to swing trading in the forex market, there are several popular strategies that traders often utilize. These strategies are designed to take advantage of short to medium-term price movements in the market. Let’s explore some of the most common swing trading strategies in forex.

Trend Following Strategy

One of the most popular swing trading strategies is trend following. This strategy involves identifying the direction of the overall trend in the market and trading in that direction. Traders look for established trends and try to ride the momentum until signs of a reversal appear. Trend following can be a profitable strategy in trending markets, but it can lead to losses in choppy or ranging markets.

Counter-Trend Trading Strategy

Counter-trend trading is another common swing trading strategy where traders look to capitalize on market reversals. This strategy involves identifying overbought or oversold conditions in the market and taking positions opposite to the prevailing trend. While counter-trend trading can be profitable during market reversals, it can also be risky as it goes against the prevailing trend.

Breakout Trading Strategy

Breakout trading is a swing trading strategy where traders aim to enter the market when the price breaks out of a key level of support or resistance. This strategy involves waiting for a clear break of a significant price level and then entering a trade in the direction of the breakout. Breakout trading can be profitable when the price continues to move in the direction of the breakout, but false breakouts can lead to losses.

Each of these swing trading strategies has its own set of advantages and disadvantages. Trend following is effective in trending markets but can result in losses during ranging markets. Counter-trend trading can be profitable during market reversals but is riskier compared to trend following. Breakout trading can lead to significant profits if the breakout is genuine, but false breakouts can result in losses.

It is essential for traders to adapt their swing trading strategies to different market conditions. This may involve switching between different strategies based on the prevailing market environment or combining multiple strategies to create a more robust trading approach. By staying flexible and adapting to changing market conditions, traders can increase their chances of success in swing trading forex.

In conclusion, mastering swing trading forex strategies requires a blend of technical analysis, risk management, and adaptability to market conditions. By developing a personalized trading plan and staying informed about the latest market trends, traders can enhance their chances of success in the competitive world of forex trading. Embrace the power of swing trading strategies to unlock the full potential of your trading journey and achieve your financial goals with confidence.

Implementing forex technical analysis strategies is crucial for traders looking to maximize their profits. By using technical analysis tools and methods, traders can identify patterns and trends in the market, helping them make well-informed trading decisions.