Kicking off with impact of regulation on crypto prices, this opening paragraph is designed to captivate and engage the readers, setting the tone semrush author style that unfolds with each word.

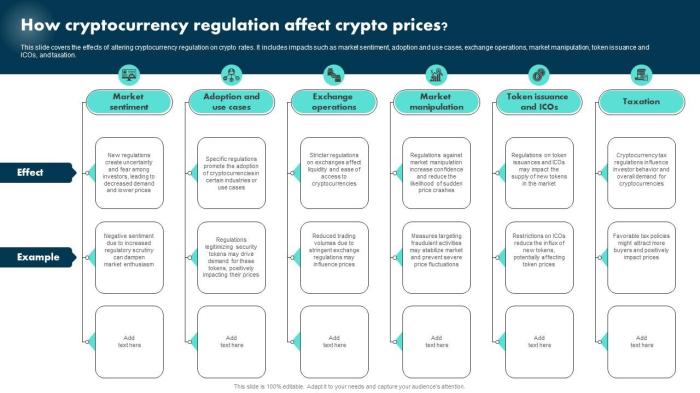

As we delve into the intricate world of cryptocurrency, the impact of regulatory measures on crypto prices becomes a focal point of discussion. Understanding how regulations influence the volatility and sentiment in the market is crucial for investors and enthusiasts alike.

Factors Influencing Crypto Prices

Regulations play a significant role in influencing the volatility of crypto prices. The introduction or announcement of new regulations can lead to a surge or drop in prices, as market participants react to the potential impact on the industry.

When it comes to understanding blockchain consensus mechanisms , it is crucial to grasp the various protocols that ensure agreement among network participants. From Proof of Work to Proof of Stake, each mechanism plays a vital role in maintaining the integrity of blockchain transactions.

Impact of Regulatory News on Crypto Prices, Impact of regulation on crypto prices

Regulatory news has a direct and immediate effect on the prices of cryptocurrencies. Positive news, such as the approval of crypto-friendly regulations, can lead to a price increase as investors gain confidence in the market. Conversely, negative news, such as bans or restrictions, can cause prices to plummet as traders fear the implications on the future of digital assets.

Monitoring social sentiment indicators for crypto is essential for gauging market trends and investor sentiment. By analyzing social media chatter and online discussions, traders can gain valuable insights into the potential direction of cryptocurrency prices.

Investor Sentiment and Regulatory Changes

Changes in regulations can significantly affect investor sentiment in the crypto market. Uncertainty surrounding the legal framework can lead to a decrease in investor confidence, resulting in a sell-off and price decline. Conversely, clear and supportive regulations can bolster investor trust and attract new capital, driving prices higher.

Exploring high-yield crypto investment options can be a lucrative venture for investors seeking substantial returns. Whether through staking, yield farming, or DeFi platforms, the crypto market offers a range of opportunities for those willing to take calculated risks.

Market Reactions to Regulatory Developments

When it comes to regulatory developments in the cryptocurrency space, market reactions can be quite volatile. Investors closely monitor announcements from regulatory bodies around the world to gauge the impact on prices of various cryptocurrencies. In this section, we will delve into examples of significant price movements in cryptocurrencies following regulatory announcements and how different types of regulations affect crypto prices.

Impact of Bans on Crypto Prices

- When a country announces a ban on cryptocurrency trading or mining, prices of affected cryptocurrencies typically plummet as investors panic and rush to sell off their holdings.

- For example, in 2021, when China reiterated its ban on cryptocurrency trading and mining, Bitcoin and other cryptocurrencies experienced a sharp decline in prices.

- Investors interpret bans as a negative signal for the future of cryptocurrencies in that particular market, leading to a sell-off and downward pressure on prices.

Effect of Regulatory Endorsements on Crypto Prices

- Conversely, when a regulatory body endorses or provides clarity on the legality of cryptocurrencies, prices tend to rise as investors perceive this as a positive development.

- For instance, when El Salvador became the first country to adopt Bitcoin as legal tender, Bitcoin’s price surged as it was seen as a validation of the cryptocurrency’s legitimacy.

- Endorsements from regulators can boost investor confidence and attract new capital into the crypto market, leading to price appreciation.

Market Adaptation and Investment Strategies

- Market participants closely monitor regulatory developments and adjust their investment strategies accordingly.

- Some investors may choose to diversify their holdings to reduce exposure to regions with stringent regulations, while others may capitalize on opportunities presented by regulatory clarity in certain jurisdictions.

- The ability to adapt to changing regulatory environments is crucial for investors in the crypto space to navigate price volatility and regulatory uncertainties.

Global Regulatory Landscape

Cryptocurrencies operate in a global environment, making regulatory frameworks a crucial factor in their market dynamics. Different countries have adopted varying approaches towards regulating cryptocurrencies, which can significantly impact their prices and overall market sentiment.

Regulatory Approaches by Major Countries

- The United States: The US has a comprehensive regulatory framework for cryptocurrencies, with agencies like the SEC and CFTC playing key roles in oversight.

- China: China has taken a strict stance on cryptocurrencies, banning initial coin offerings (ICOs) and cracking down on crypto mining operations.

- Japan: Japan has embraced cryptocurrencies with a regulatory framework that recognizes them as legal tender, contributing to a thriving crypto market in the country.

- South Korea: South Korea has implemented regulations to prevent money laundering and fraud in the crypto market, while also fostering innovation in blockchain technology.

Impact of Strict vs. Crypto-Friendly Regulations

- Strict Regulations: Countries with stringent regulations often see a short-term negative impact on crypto prices due to uncertainty and market fear. However, in the long run, clear regulations can improve investor confidence and attract institutional money.

- Crypto-Friendly Regulations: Nations with supportive regulatory environments tend to experience positive market reactions, with increased investment inflows and a flourishing crypto ecosystem. However, they may also face challenges related to consumer protection and security.

Cross-Border Regulations and Valuation

- Cross-border regulations play a crucial role in shaping the overall valuation of cryptocurrencies, as inconsistencies in regulatory approaches can lead to market volatility and uncertainty.

- Harmonizing regulations across countries can help stabilize crypto prices and foster a more sustainable growth trajectory for the global crypto market.

Future Trends and Predictions: Impact Of Regulation On Crypto Prices

In the ever-evolving landscape of cryptocurrency regulation, it is crucial to anticipate how upcoming changes could impact the prices of digital assets. Regulatory developments have a significant influence on market sentiment and investor confidence, ultimately affecting the value of cryptocurrencies. Let’s explore some potential future trends and predictions in this regard.

Impact of Regulatory Changes on Crypto Prices

With increased regulatory scrutiny and potential new laws around the world, the cryptocurrency market is likely to experience heightened volatility. Uncertainty regarding the legal status of digital assets can lead to price fluctuations as market participants adjust their strategies in response to regulatory changes. For instance, if a major jurisdiction introduces strict regulations that restrict the use of certain cryptocurrencies, we may see a decline in their prices due to decreased demand and liquidity.

Regulatory Clarity and Market Sentiment

On the other hand, clear and favorable regulatory frameworks can instill confidence in investors and drive a surge in crypto prices. If regulatory clarity is achieved in key markets, such as the United States or the European Union, we could witness a significant rally in the prices of cryptocurrencies as institutional investors and retail traders gain more certainty about the legal environment. This positive sentiment could attract more capital into the market and fuel a bullish trend in the long run.

Long-Term Implications of Regulatory Frameworks

Looking ahead, the establishment of comprehensive regulatory frameworks for cryptocurrencies could contribute to the stability and growth of the market. Clear rules and enforcement mechanisms can help prevent fraud, money laundering, and other illicit activities, making the crypto space more attractive to mainstream investors and institutions. As regulatory oversight increases, we may see a more mature and sustainable market emerge, with greater investor protection and market integrity. However, overly restrictive regulations could stifle innovation and hinder the development of the industry, leading to potential challenges for the future adoption and growth of cryptocurrencies.

In conclusion, the impact of regulation on crypto prices is a complex interplay of market reactions, global regulatory landscapes, and future trends. Navigating this landscape requires a deep understanding of how regulations shape the crypto market and influence investment decisions. Stay informed, stay vigilant, and embrace the evolving dynamics of the crypto world.