Kicking off with market sentiment indicators forex, this opening paragraph is designed to captivate and engage the readers, setting the tone for what’s to come. Exploring the importance of these indicators and how they influence trading decisions is crucial for any forex trader looking to navigate the market successfully.

When it comes to forex trading, understanding market sentiment indicators can make or break your strategy. Let’s dive into the world of these indicators and how they play a pivotal role in determining currency price movements.

Importance of Market Sentiment Indicators in Forex

Market sentiment indicators play a crucial role in forex trading decisions, providing traders with valuable insights into the market mood and potential price movements. By analyzing market sentiment, traders can better understand the collective attitude of market participants towards a particular currency pair, helping them make more informed trading decisions.

Popular Market Sentiment Indicators

- Commitment of Traders (COT) Report: This report provides a breakdown of the open interest positions held by different types of traders, such as commercial hedgers, large speculators, and small speculators. Traders use this data to gauge market sentiment and identify potential trends.

- Sentiment Surveys: Surveys conducted among traders and analysts can offer insights into market sentiment. Popular sentiment surveys include the Investors Intelligence Sentiment Index and the AAII Investor Sentiment Survey.

- Volatility Index (VIX): The VIX measures market expectations for volatility in the stock market, but it can also be used as an indicator of fear and uncertainty in the forex market. High VIX levels may indicate heightened market sentiment and potential currency price movements.

Relationship Between Market Sentiment Indicators and Currency Price Movements

Market sentiment indicators can influence currency price movements by impacting traders’ behavior and market dynamics. For example, if a sentiment survey reveals a bearish outlook on a currency pair, traders may start selling that currency, leading to a decrease in its value. On the other hand, a positive sentiment can attract buyers and drive up the currency’s price.

Overall, market sentiment indicators serve as valuable tools for forex traders to gauge market sentiment, identify potential trends, and make informed trading decisions based on the collective mood of market participants.

Types of Market Sentiment Indicators for Forex: Market Sentiment Indicators Forex

Market sentiment indicators in forex trading play a crucial role in helping traders make informed decisions. These indicators provide insights into the overall mood of the market participants, whether bullish (positive sentiment) or bearish (negative sentiment). Understanding the different types of market sentiment indicators can help traders anticipate potential market movements and adjust their trading strategies accordingly.

Technical Indicators

Technical indicators are commonly used to gauge market sentiment in forex trading. These indicators analyze historical price data, volume, and other market variables to identify trends and patterns. Some popular technical indicators used to measure market sentiment include moving averages, Relative Strength Index (RSI), and Bollinger Bands. These indicators help traders determine the strength of a trend, potential reversal points, and overbought or oversold conditions in the market.

Fundamental Indicators

Fundamental indicators focus on economic data, geopolitical events, and other external factors that can impact market sentiment. These indicators include reports on economic growth, inflation, interest rates, and geopolitical developments. By analyzing fundamental indicators, traders can gain insights into the underlying factors driving market sentiment and make more informed trading decisions based on macroeconomic trends.

Leading vs. Lagging Indicators, Market sentiment indicators forex

Leading indicators are signals that precede actual market movements, providing early indications of potential trend changes. Examples of leading indicators include moving averages crossover, MACD divergences, and stochastic oscillator signals. On the other hand, lagging indicators are signals that confirm market trends after they have already started. Examples of lagging indicators include moving averages, Parabolic SAR, and the Average True Range (ATR). Traders use a combination of leading and lagging indicators to confirm trends and make timely trading decisions in the forex market.

Interpreting Market Sentiment Indicators

When it comes to interpreting market sentiment indicators in forex trading, it is essential to understand how to decipher bullish and bearish signals, as well as how to incorporate multiple indicators into your analysis.

Process of Interpreting Bullish and Bearish Signals

- For bullish signals, look for indicators showing that market participants are optimistic and confident in the market’s upward potential. This could include increasing buying volume, positive news sentiment, or a rise in bullish positions.

- On the other hand, bearish signals indicate a pessimistic view of the market. This could be reflected in high levels of selling volume, negative news sentiment, or an increase in bearish positions.

- It is crucial to look for confirmation from multiple indicators to validate the signal and avoid relying on a single source of information.

Strategy for Incorporating Multiple Sentiment Indicators

- Start by selecting a combination of sentiment indicators that complement each other, such as sentiment surveys, positioning data, and news sentiment analysis.

- Compare the signals from each indicator to identify areas of convergence or divergence, which can provide more robust trading signals.

- Consider the weight of each indicator based on its reliability and relevance to the current market conditions.

Real-life Scenarios Influenced by Market Sentiment Indicators

- During major economic announcements, sentiment indicators can help traders gauge market expectations and react to the news accordingly.

- In times of geopolitical uncertainty, sentiment indicators can provide insights into market sentiment shifts and potential trading opportunities.

- Market sentiment indicators played a significant role in the volatility surrounding the Brexit negotiations, guiding traders on market sentiment towards the British pound.

Tools and Resources for Market Sentiment Analysis in Forex

In the realm of forex trading, market sentiment analysis plays a crucial role in making informed trading decisions. Utilizing the right tools and resources for market sentiment analysis can provide traders with valuable insights into market trends and potential price movements. In this section, we will explore some of the top tools and resources available for market sentiment analysis in forex trading.

Online Platforms and Software for Market Sentiment Data

- Forex Factory: Forex Factory is a popular online platform that provides traders with real-time market sentiment data, including news, economic calendar events, and forum discussions.

- Sentiment Trader: Sentiment Trader is a software tool that aggregates market sentiment data from various sources and presents it in an easy-to-understand format for traders.

- TradingView: TradingView is a comprehensive charting platform that also offers market sentiment indicators, social sentiment tools, and sentiment analysis features for forex traders.

Tips for Staying Updated with Market Sentiment Trends

- Follow Economic News: Stay informed about major economic events, news releases, and central bank announcements that can impact market sentiment.

- Monitor Social Media: Keep an eye on social media platforms like Twitter, Reddit, and financial forums for real-time discussions and sentiment analysis on forex markets.

- Use Sentiment Analysis Tools: Regularly utilize sentiment analysis tools and resources to track changes in market sentiment and identify potential trading opportunities.

Role of Sentiment Analysis Tools in Forex Trading Strategy

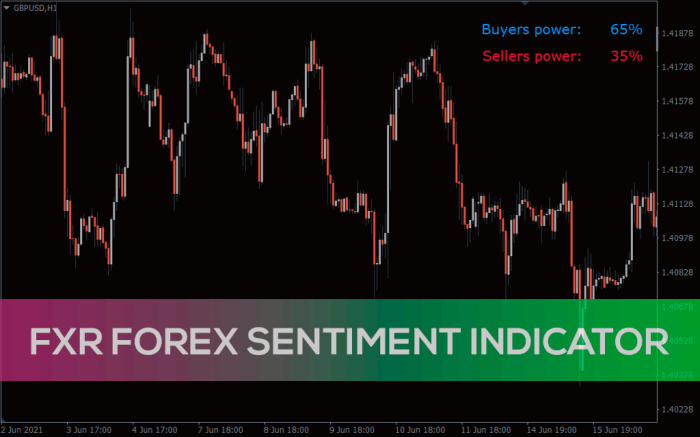

- Identifying Market Sentiment: Sentiment analysis tools help traders gauge the overall sentiment of market participants, which can influence price movements in the forex market.

- Confirmation of Trade Decisions: By incorporating market sentiment indicators into their analysis, traders can confirm their trade decisions and align them with prevailing market sentiment.

- Risk Management: Market sentiment analysis tools assist traders in managing risk by providing insights into potential market reversals or shifts in sentiment.

In conclusion, market sentiment indicators in forex are powerful tools that can provide valuable insights for traders. By incorporating these indicators into your analysis and staying updated on the latest trends, you can make more informed trading decisions and enhance your overall strategy.

When it comes to analyzing forex trends effectively , traders need to utilize technical tools and indicators to identify patterns and make informed decisions. By studying price movements and historical data, traders can predict potential market movements and adjust their strategies accordingly.

Understanding forex sentiment analysis is crucial for interpreting market psychology and trader behavior. By analyzing the overall sentiment of market participants, traders can gauge market direction and make decisions based on market sentiment, which can be a key factor in successful forex trading.

Fundamental analysis for forex trading involves evaluating economic indicators, geopolitical events, and market news to determine the intrinsic value of a currency. By understanding the underlying factors driving currency movements, traders can make more informed trading decisions and anticipate market trends.