Price action trading strategies forex sets the stage for profitable trading opportunities, offering a deep dive into the world of forex trading with a focus on strategic maneuvers and insightful analysis.

This paragraph will provide a comprehensive overview of the key components of price action trading strategies, highlighting the importance of understanding support and resistance levels, analyzing candlestick patterns, and leveraging trends for successful trading outcomes.

Overview of Price Action Trading Strategies in Forex: Price Action Trading Strategies Forex

Price action trading is a method of analyzing and predicting price movements in the forex market based on actual price movements, rather than relying on indicators or technical analysis tools. Traders using price action trading strategies focus on the historical price movements of a particular currency pair to make trading decisions.

Price action trading is considered important in the forex market because it provides a clear and straightforward way to analyze market trends and patterns. By observing how prices have moved in the past, traders can identify potential future price movements and make informed trading decisions.

Common Price Action Trading Strategies

- Pin Bar Strategy: This strategy involves looking for a specific candlestick pattern called a pin bar, which indicates a potential reversal in price direction.

- Inside Bar Strategy: Traders using this strategy look for inside bars, where the high and low of a candle are within the high and low of the previous candle, signaling a potential breakout.

- Engulfing Candle Strategy: This strategy involves identifying engulfing candle patterns, where one candle completely engulfs the previous candle, indicating a potential reversal or continuation of the trend.

Price action trading differs from other trading methods, such as indicator-based trading, as it relies solely on the analysis of price movements without the use of lagging indicators or oscillators. Traders using price action strategies believe that price movements are the most reliable indicator of market sentiment and future price movements, making it a popular approach among forex traders.

Key Components of Price Action Trading Strategies

Price action trading strategies in forex rely on several key components that help traders analyze and interpret market movements. These components include support and resistance levels, candlestick patterns, and trends.

Support and Resistance Levels

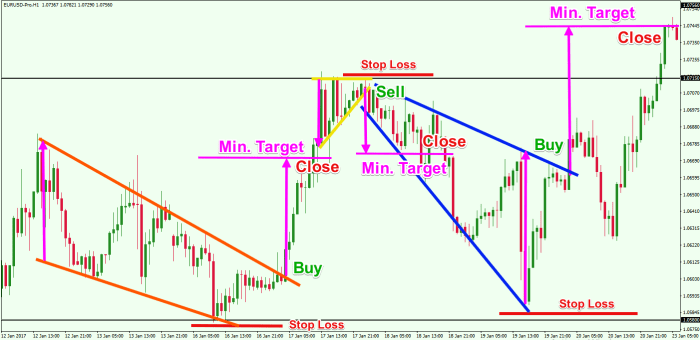

Support and resistance levels play a crucial role in price action trading strategies. Support represents a price level where a downtrend is expected to pause or reverse, while resistance is a level where an uptrend is likely to stall or reverse. Traders use these levels to identify potential entry and exit points for their trades. When price approaches a support or resistance level, traders pay close attention to how the market reacts, looking for signs of a reversal or continuation.

Candlestick Patterns

Candlestick patterns are another essential element of price action trading. These patterns provide valuable insights into market sentiment and help traders make informed decisions. For example, a bullish engulfing pattern, where a large bullish candle engulfs the previous bearish candle, signals a potential reversal to the upside. Traders use these patterns in conjunction with other technical analysis tools to confirm their trading decisions.

Trends

Trends are a fundamental aspect of price action trading strategies. Traders aim to identify the direction of the trend and trade in alignment with it to increase their chances of success. By analyzing price movements over time, traders can determine whether the market is in an uptrend, downtrend, or ranging. Trend analysis helps traders filter out noise and focus on high-probability trading opportunities that align with the prevailing market direction.

Implementing Price Action Trading Strategies

When it comes to implementing price action trading strategies in the forex market, beginners often find themselves overwhelmed with the vast amount of information available. To help simplify the process, it’s important to start with the basics and gradually build your knowledge and skills. Here are some tips and guidelines to get you started on the right track.

Tips for Beginners, Price action trading strategies forex

- Start by focusing on a few key price action patterns such as pin bars, inside bars, and engulfing patterns. Mastering these patterns will give you a solid foundation to build upon.

- Practice on a demo account before risking real money. This will help you gain confidence in your trading abilities and refine your skills without the pressure of losing capital.

- Keep a trading journal to track your progress, record your trades, and analyze your performance. This will help you identify areas for improvement and fine-tune your strategy over time.

- Stay disciplined and stick to your trading plan. Avoid emotional decision-making and follow your rules consistently to maintain a successful trading mindset.

Reading and Interpreting Price Action Charts

- Start by identifying key support and resistance levels on the chart. These levels can help you determine potential entry and exit points for your trades.

- Look for price action signals such as candlestick patterns, chart patterns, and trend indicators to confirm your trading decisions. These signals can provide valuable insights into market sentiment and potential price movements.

- Pay attention to the overall market context, including major economic events, news releases, and market sentiment. Understanding the broader market environment can help you make more informed trading decisions.

Importance of Risk Management

- Always use proper risk management techniques such as setting stop-loss orders, position sizing, and maintaining a risk-to-reward ratio of at least 1:2. This will help protect your capital and minimize potential losses.

- Avoid over-leveraging your trades and risking more than you can afford to lose. Stick to a consistent risk management strategy to preserve your trading account in the long run.

- Regularly review and adjust your risk management plan based on your trading performance and market conditions. Adaptability is key to long-term success in trading.

Combining Price Action with Technical Indicators

- Consider using technical indicators such as moving averages, oscillators, and volume indicators to complement your price action analysis. These tools can provide additional confirmation signals and help validate your trade setups.

- Avoid relying solely on technical indicators without considering price action. Price action is the ultimate indicator of market sentiment and should be the primary focus of your analysis.

- Experiment with different combinations of price action and technical indicators to find a strategy that works best for your trading style and preferences.

Advantages and Disadvantages of Price Action Trading in Forex

Price action trading in Forex offers numerous advantages for traders, but it also comes with its own set of challenges. Let’s explore the benefits and drawbacks of using price action strategies in the foreign exchange market.

Advantages of Price Action Trading

- Clear and Simple Charts: Price action trading focuses on reading and interpreting price movements directly from the charts, eliminating the need for complex indicators or algorithms.

- Flexible and Adaptable: Price action strategies can be applied to any financial instrument and time frame, allowing traders to adjust their approach based on market conditions.

- Enhanced Risk Management: By using price action signals to enter and exit trades, traders can effectively manage risk and protect their capital.

- Improved Decision Making: Price action trading helps traders develop a deeper understanding of market dynamics and make more informed trading decisions.

Disadvantages of Price Action Trading

- Subjectivity: Interpreting price action can be subjective, leading to different conclusions among traders and potential confusion.

- Emotional Bias: Without clear rules or guidelines, traders may fall victim to emotional decision-making, leading to impulsive trading behavior.

- Time-Intensive: Analyzing price action requires time and effort to develop the necessary skills and experience, which can be challenging for new traders.

- Limited Predictive Power: While price action can provide valuable insights, it may not always accurately predict future price movements, leading to potential losses.

Effectiveness of Price Action Trading

Price action trading has proven to be effective for many traders, especially those who have mastered the art of reading price movements accurately. Compared to other trading approaches that rely heavily on indicators or algorithms, price action trading offers a more intuitive and holistic view of the market. By focusing on pure price movements, traders can develop a deeper understanding of market dynamics and make more informed trading decisions.

Real-Life Examples of Successful Price Action Trading

One notable example of successful price action trading is the “pin bar” strategy, where traders look for specific candlestick patterns to identify potential reversals or continuations in the market. By mastering the art of reading price action signals, traders can achieve consistent profitability in their trading endeavors.

In conclusion, mastering price action trading strategies forex opens doors to endless possibilities in the dynamic forex market, empowering traders to make informed decisions and capitalize on lucrative opportunities.

When trading forex, understanding the correlation between currencies in forex is crucial for making informed decisions. Knowing how different currency pairs move in relation to each other can help traders anticipate market movements.

For those looking to achieve long-term profits in forex , implementing top strategies is essential. Strategies such as trend following, range trading, and breakout trading can help traders stay profitable over time.

One popular strategy in forex trading is the forex breakout trading strategy. This strategy involves identifying key levels of support and resistance and entering trades when price breaks out of these levels, aiming for high-profit potential.