How to buy bonds online: Are you looking to invest in bonds but unsure where to start? This comprehensive guide will walk you through the process of purchasing bonds digitally, from understanding the different types available to navigating online platforms with ease.

In today’s digital age, buying bonds online offers convenience and accessibility that traditional methods may lack.

Introduction to Buying Bonds Online

When it comes to investing, bonds are a popular choice for many individuals. Bonds are essentially loans made by investors to corporations or government entities in exchange for regular interest payments. People invest in bonds to earn a stable income and preserve capital, as they are considered a relatively safer investment compared to stocks.

One of the key benefits of buying bonds online is the ease and convenience it offers to investors. Online platforms provide a user-friendly interface that allows individuals to research, compare, and purchase bonds from the comfort of their own homes. This eliminates the need to visit a physical bank or brokerage firm, saving time and effort in the process.

Overview of Buying Bonds Online

- Access to a wide range of bond options

- Ability to research and compare bonds easily

- Convenience of making purchases anytime, anywhere

- Efficient management of bond portfolio online

Types of Bonds Available Online

When buying bonds online, investors have access to a variety of options, including government bonds, corporate bonds, and municipal bonds. Each type of bond comes with its own features and risks that investors should consider before making a purchase.

Government Bonds

Government bonds are issued by national governments to fund public projects and services. They are considered low-risk investments because they are backed by the government’s ability to tax its citizens. Examples of government bonds include U.S. Treasury bonds and Canadian Government bonds. These bonds typically offer lower interest rates compared to other types of bonds.

Corporate Bonds

Corporate bonds are issued by corporations to raise capital for various purposes, such as expansion or debt refinancing. These bonds offer higher interest rates compared to government bonds but come with a higher level of risk. If the issuing company goes bankrupt, investors may lose their investment. Popular online platforms where investors can buy corporate bonds include Fidelity Investments and TD Ameritrade.

Municipal Bonds

Municipal bonds are issued by state and local governments to finance public projects like infrastructure improvements or schools. These bonds are exempt from federal taxes and may also be exempt from state and local taxes, making them a popular choice for investors seeking tax advantages. Examples of online platforms where investors can buy municipal bonds include Charles Schwab and Vanguard.

How to Choose the Right Bonds

When buying bonds online, it is crucial to select the right ones based on your financial goals and risk tolerance. Factors such as credit ratings, yield, and diversification play a key role in making informed decisions.

Factors to Consider When Selecting Bonds

- Assess your risk tolerance: Determine how much risk you are willing to take on with your investments. Bonds with higher yields often come with higher risks.

- Define your investment goals: Consider whether you are looking for income, capital preservation, or a combination of both when choosing bonds.

- Evaluate your time horizon: Determine how long you plan to hold the bonds, as this will impact the type of bonds you should invest in.

Importance of Credit Ratings and Yield

When selecting bonds online, it is essential to pay attention to credit ratings and yield:

- Credit ratings: Look for bonds with high credit ratings to minimize the risk of default. Ratings agencies like Moody’s and Standard & Poor’s provide valuable insights into the creditworthiness of bond issuers.

- Yield: Consider the yield offered by bonds, which indicates the return you can expect to receive. Compare yields across different bonds to find the best investment opportunities.

Tips on Diversifying a Bond Portfolio

Diversification is key to managing risk and optimizing returns in your bond portfolio:

- Invest in bonds from different issuers and industries to spread risk.

- Consider bonds with varying maturities to balance short-term and long-term investment objectives.

- Explore bonds with different credit ratings to create a well-rounded portfolio that can withstand market fluctuations.

Steps to Buy Bonds Online: How To Buy Bonds Online

When it comes to buying bonds online, there are several key steps you need to follow to ensure a smooth and successful transaction.

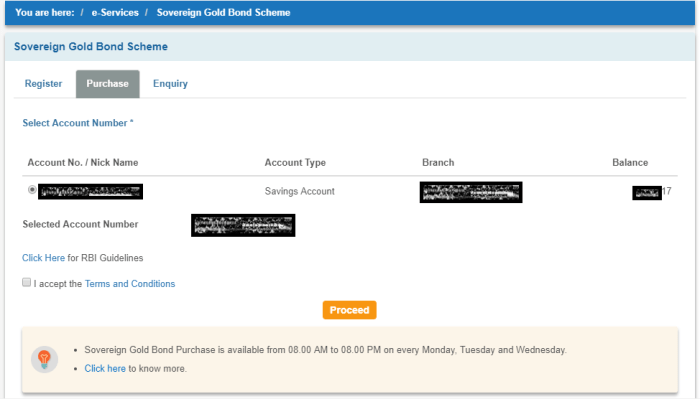

Setting Up Your Account

Before you can start buying bonds online, you’ll need to set up an account with a reputable online brokerage platform. This typically involves providing personal information, verifying your identity, and funding your account.

Researching Bonds, How to buy bonds online

Once your account is set up, the next step is to research the different types of bonds available online. This includes understanding the various bond options, their risks and potential returns, as well as the issuer’s credit rating.

Comparing Prices and Yields

When buying bonds online, it’s essential to compare prices and yields on different platforms to ensure you’re getting the best deal. Look for platforms that offer competitive pricing and transparent information on bond yields.

Placing Your Order

After conducting your research and deciding on the bonds you want to purchase, the next step is to place your order. This typically involves specifying the quantity of bonds you wish to buy and the price at which you’re willing to purchase them.

Security Measures

Online bond transactions are secured through various measures to protect your personal and financial information. Look for platforms that offer encryption, two-factor authentication, and other security features to ensure a safe and secure transaction.

Risks and Considerations

When buying bonds online, there are several risks and considerations that investors need to be aware of to make informed decisions. These risks can impact the returns on your investments and the overall performance of your bond portfolio. It is crucial to understand these risks and take appropriate measures to mitigate them.

Potential Risks Associated with Buying Bonds Online

- Interest Rate Risk: Fluctuations in interest rates can affect the value of your bonds. When interest rates rise, bond prices tend to fall, and vice versa. This risk can impact the overall performance of your bond portfolio.

- Credit Risk: This risk refers to the issuer’s ability to repay the bond’s principal and interest payments. Investing in bonds issued by lower-rated companies or governments can expose you to higher credit risk.

Importance of Conducting Thorough Research

Before purchasing bonds online, it is essential to conduct thorough research to understand the bond’s terms, conditions, and risks involved. Investors should analyze the issuer’s creditworthiness, the bond’s maturity date, interest rate, and any call provisions. Researching the bond market trends and economic conditions can help investors make informed decisions and minimize risks.

Tips on Monitoring and Managing a Bond Portfolio

- Regularly Review Your Portfolio: Keep track of your bond investments and monitor their performance over time. Reviewing your portfolio can help you identify any underperforming bonds or potential risks.

- Diversify Your Holdings: Diversification is key to managing risk in a bond portfolio. Invest in bonds with varying maturities, issuers, and credit ratings to spread out risk and potentially enhance returns.

- Stay Informed: Stay updated on market trends, economic indicators, and any news that may impact the bond market. Being informed can help you make timely decisions and adjust your portfolio accordingly.

In conclusion, buying bonds online can be a smart way to diversify your investment portfolio and potentially earn attractive returns. By following the steps Artikeld in this guide and staying informed about the risks involved, you can make informed decisions when it comes to investing in bonds online.