AML compliance in crypto is a crucial aspect that demands attention in the ever-evolving landscape of digital currencies. Let’s delve into the intricate world of regulatory requirements and security measures that shape the operations of crypto businesses.

AML Compliance Overview

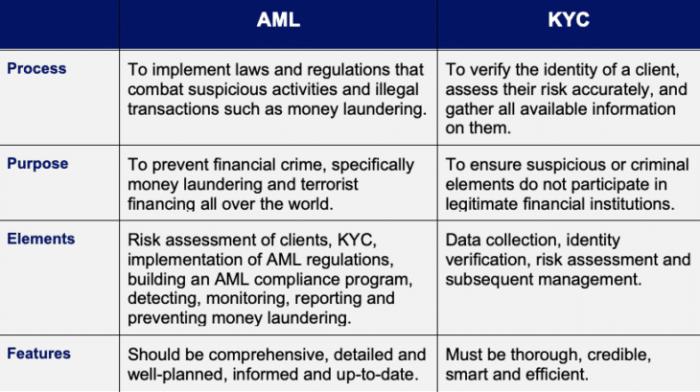

Anti-Money Laundering (AML) compliance in the cryptocurrency industry refers to the measures and regulations put in place to prevent the illegal activities of money laundering and terrorist financing within the digital asset space.

Keeping up with the latest blockchain technology trends is essential for anyone involved in the crypto space. From the rise of decentralized finance (DeFi) to the integration of non-fungible tokens (NFTs), the industry is constantly evolving. Staying informed about these trends can help investors and developers make strategic decisions in this fast-paced environment.

AML compliance is crucial for crypto businesses to maintain the integrity of the financial system, protect against financial crimes, and ensure they are not unwittingly involved in illegal activities. Failure to comply with AML regulations can lead to severe penalties, including hefty fines and reputational damage.

For those interested in short-term crypto trading strategy, decentralized crypto wallets, and beginner’s guide to crypto analysis , having a solid understanding of these topics is crucial. Developing effective trading strategies, securing your assets in decentralized wallets, and analyzing market trends can help you navigate the volatile world of cryptocurrencies and maximize your profits.

Examples of AML Regulations Relevant to Cryptocurrencies

- The Financial Action Task Force (FATF) provides international standards for AML compliance, which many countries adopt and enforce within their jurisdictions.

- The Bank Secrecy Act (BSA) in the United States requires cryptocurrency exchanges to register with the Financial Crimes Enforcement Network (FinCEN) and implement AML programs.

- The European Union’s Fifth Anti-Money Laundering Directive (5AMLD) includes specific requirements for virtual asset service providers (VASPs) to conduct customer due diligence and report suspicious transactions.

AML Compliance Requirements

When it comes to Anti-Money Laundering (AML) compliance in the crypto sector, there are several key requirements that businesses need to adhere to in order to prevent financial crimes. These requirements are crucial for maintaining the integrity of the industry and ensuring that cryptocurrencies are not used for illicit activities.

Key Requirements for AML Compliance in the Crypto Sector, AML compliance in crypto

- Customer Due Diligence: Crypto businesses must conduct thorough customer due diligence to verify the identity of their customers and assess the risk of money laundering or terrorist financing.

- Transaction Monitoring: Implementing robust transaction monitoring systems to detect and report suspicious activities in a timely manner is essential for AML compliance.

- Record Keeping: Maintaining accurate records of transactions, customer information, and AML compliance efforts is a fundamental requirement in the crypto sector.

- Suspicious Activity Reporting: Promptly reporting any suspicious transactions or activities to the relevant authorities is crucial for combating money laundering and terrorist financing.

Ensuring Adherence to AML Regulations

Crypto businesses can ensure adherence to AML regulations by implementing strong AML compliance programs, conducting regular risk assessments, providing employee training, and collaborating with law enforcement agencies and regulatory bodies.

When it comes to blockchain technology, understanding the difference between Proof of Work vs Proof of Stake is crucial. While Proof of Work requires miners to solve complex mathematical puzzles to validate transactions, Proof of Stake relies on validators who are chosen to create new blocks based on the amount of cryptocurrency they hold. These two consensus mechanisms have their own advantages and drawbacks, shaping the future of blockchain networks.

Comparison of AML Compliance Requirements

While traditional financial institutions and crypto businesses share similar AML compliance requirements, there are some key differences. Crypto businesses may face additional challenges due to the decentralized nature of cryptocurrencies and the anonymity they provide to users. However, both types of entities must adhere to strict AML regulations to prevent financial crimes and protect the integrity of the financial system.

AML Compliance Technologies: AML Compliance In Crypto

In the ever-evolving landscape of cryptocurrency, AML compliance technologies play a crucial role in ensuring the integrity of financial transactions and preventing illicit activities. These technologies leverage various tools and software to monitor, detect, and report suspicious activities in compliance with anti-money laundering regulations.

Common AML Compliance Tools and Software

- Transaction Monitoring Systems: These tools analyze transactional data in real-time to identify any unusual patterns or behaviors that may indicate money laundering activities.

- Know Your Customer (KYC) Software: KYC solutions verify the identities of users by collecting personal information and conducting identity checks to prevent fraudulent activities.

- Blockchain Analysis Tools: These tools track and analyze blockchain transactions to identify illicit activities and ensure compliance with AML regulations.

- Risk Assessment Software: AML compliance technologies include risk assessment tools that evaluate the level of risk associated with each transaction or customer to prioritize monitoring efforts.

Benefits and Challenges of Implementing AML Compliance Technologies

Implementing AML compliance technologies offers several benefits, such as:

- Enhanced Detection Capabilities: Technology enables automated monitoring and analysis of large volumes of data, improving the detection of suspicious activities.

- Efficiency and Cost-Effectiveness: AML compliance technologies streamline compliance processes, reducing manual efforts and operational costs for businesses.

- Regulatory Compliance: By leveraging advanced tools and software, cryptocurrency businesses can ensure compliance with AML regulations and avoid hefty fines or penalties.

However, there are challenges associated with implementing AML compliance technologies, including:

- Complexity and Integration Issues: Integrating AML technologies with existing systems can be complex and time-consuming, requiring significant resources and expertise.

- Data Privacy Concerns: The collection and storage of sensitive customer data for AML purposes raise privacy concerns and compliance challenges under data protection regulations.

- Ongoing Maintenance and Updates: AML compliance technologies require regular maintenance and updates to stay effective against evolving money laundering techniques and regulatory requirements.

AML Compliance Best Practices

When it comes to AML compliance in the crypto industry, there are several best practices that organizations can follow to ensure they are meeting regulatory requirements and mitigating the risks associated with money laundering and terrorist financing.

Establishing Strong Internal Controls

One of the key best practices for AML compliance is to establish strong internal controls within the organization. This includes implementing policies and procedures that govern how the organization will identify and mitigate money laundering risks. By having clear guidelines in place, organizations can ensure that all employees are aware of their responsibilities and can work together to prevent illicit activities.

- Regular training sessions for employees to stay updated on AML regulations

- Implementing transaction monitoring systems to detect suspicious activities

- Conducting thorough customer due diligence to verify the identities of clients

- Regularly reviewing and updating AML policies and procedures

Conducting Effective AML Risk Assessments

Another important best practice is to conduct regular and effective AML risk assessments. By assessing the risks associated with money laundering and terrorist financing, organizations can identify areas of weakness and take steps to strengthen their AML compliance program.

It is crucial to conduct risk assessments on a regular basis to ensure that the organization’s AML program remains effective and up to date.

- Utilize risk assessment tools to identify and prioritize risks

- Engage with industry experts to gain insights into emerging risks

- Review risk assessment results and adjust AML strategies accordingly

Successful AML Compliance Strategies

Leading cryptocurrency firms have adopted successful AML compliance strategies to stay ahead of regulatory requirements and protect their businesses from financial crimes. Some examples of effective strategies include:

- Collaborating with law enforcement agencies to share information on suspicious activities

- Implementing blockchain analytics tools to track and trace transactions on the blockchain

- Leveraging artificial intelligence and machine learning to enhance AML monitoring capabilities

- Engaging with regulators and industry peers to stay informed on AML developments

In conclusion, navigating the realm of AML compliance in the crypto sphere requires a delicate balance of innovation and adherence to regulations. By staying informed and implementing best practices, businesses can thrive in this dynamic environment while safeguarding against financial crimes.