Understanding crypto tax obligations is essential in today’s digital age, where cryptocurrencies are gaining popularity. This article delves into the importance of complying with tax laws to avoid legal issues and explores strategies for managing your crypto tax liabilities effectively.

Importance of Understanding Crypto Tax Obligations

Understanding crypto tax obligations is crucial for individuals involved in cryptocurrency transactions as it ensures compliance with tax laws and regulations. Failing to understand these obligations can lead to serious legal consequences and financial penalties.

Consequences of Ignorance of Crypto Tax Laws

Ignorance of crypto tax laws can result in unintentional tax evasion or underpayment. For example, if an individual fails to report their cryptocurrency gains on their tax return, they may face audits, fines, and even criminal charges for tax fraud.

Furthermore, failing to accurately report cryptocurrency transactions can trigger IRS enforcement actions, including penalties and interest on unpaid taxes. This can significantly impact an individual’s financial stability and reputation.

For traders interested in a more dynamic approach, mastering a short-term crypto trading strategy is essential. Additionally, understanding decentralized crypto wallets and the basics of crypto analysis can help traders make informed decisions in the volatile crypto market.

Implications of Non-Compliance with Crypto Tax Regulations

Non-compliance with crypto tax regulations can lead to various consequences, such as tax audits, fines, and legal action. The IRS has been increasing its efforts to enforce compliance with crypto tax laws, making it essential for individuals to accurately report their cryptocurrency transactions.

When it comes to top blockchain platforms , there are several options available in the market that offer secure and efficient services for blockchain technology. These platforms play a crucial role in facilitating transactions and data management in a decentralized system.

Additionally, failure to comply with crypto tax regulations can result in reputational damage, as individuals may be viewed as engaging in tax evasion or financial misconduct. It is crucial for individuals to understand and fulfill their tax obligations to avoid these negative implications.

For those looking for a stable investment opportunity, long-term cryptocurrency investment can be a viable option. By holding onto digital assets for an extended period, investors can potentially benefit from the growth of the cryptocurrency market over time.

Basics of Crypto Taxation

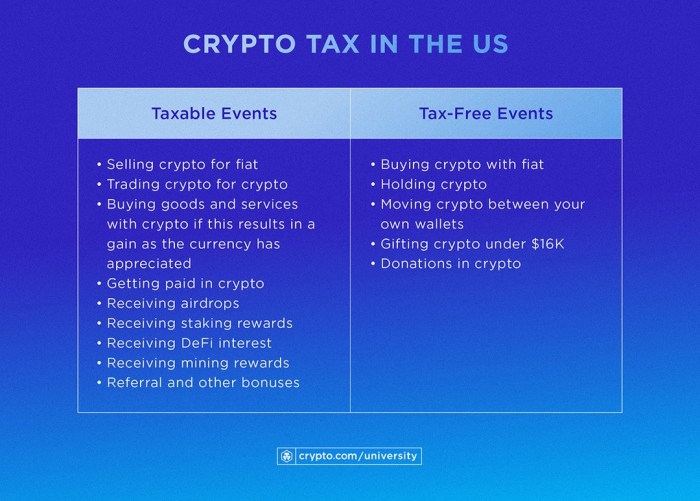

Cryptocurrencies are taxed in various ways, primarily based on the type of transaction and the jurisdiction’s tax laws. The most common forms of taxation for cryptocurrencies include capital gains tax and income tax. Capital gains tax is applied when a crypto asset is sold for more than its original purchase price, while income tax is levied on mining rewards or crypto received as payment for goods or services.

Different Ways Cryptocurrencies are Taxed

- Capital Gains Tax: This tax is imposed when a cryptocurrency is sold at a profit compared to the initial purchase price. The difference between the selling price and the purchase price is considered a capital gain and is subject to taxation.

- Income Tax: Crypto received as payment for goods or services, mining rewards, or staking rewards are treated as income and are subject to income tax.

Reporting Crypto Transactions to Tax Authorities

- Crypto transactions are reported to tax authorities through various means, such as filing tax returns, providing detailed records of transactions, and adhering to specific reporting requirements set by tax agencies.

- Some jurisdictions require the use of specific tax forms or software to report crypto transactions accurately and ensure compliance with tax laws.

Examples of Taxable Events in the Crypto Space

- Selling Cryptocurrency: Any profit made from selling cryptocurrencies is considered a taxable event and must be reported to tax authorities.

- Using Crypto for Purchases: Using cryptocurrency to buy goods or services may trigger a taxable event, as it involves the conversion of the digital asset into fiat currency at the prevailing market rate.

- Receiving Mining Rewards: Mining rewards earned by validating transactions on a blockchain network are considered taxable income and must be reported accordingly.

Strategies for Managing Crypto Tax Obligations: Understanding Crypto Tax Obligations

When it comes to managing crypto tax obligations, there are several strategies that can help individuals navigate the complexities of cryptocurrency taxation. From keeping accurate records to utilizing tax planning strategies, here are some tips to consider.

Keeping Accurate Records of Crypto Transactions, Understanding crypto tax obligations

One of the most important steps in managing crypto tax obligations is to keep detailed records of all cryptocurrency transactions. This includes information such as the date of the transaction, the amount of cryptocurrency exchanged, the value of the cryptocurrency at the time of the transaction, and any fees incurred.

By maintaining accurate records, individuals can easily calculate their capital gains or losses when it comes time to report their crypto taxes. This can help ensure compliance with tax regulations and minimize the risk of audits.

Utilizing Tools or Software for Calculating Crypto Taxes

There are several tools and software available that can help individuals calculate their crypto taxes more efficiently. These tools can automate the process of tracking transactions, calculating gains and losses, and generating tax reports.

By utilizing these tools, individuals can save time and reduce the likelihood of errors when reporting their crypto taxes.

Comparing Tax Planning Strategies for Minimizing Tax Liabilities

When it comes to minimizing tax liabilities in the crypto sector, there are various tax planning strategies that individuals can consider. These strategies may include techniques such as tax-loss harvesting, holding investments for longer periods to qualify for lower capital gains tax rates, and utilizing tax-deferred accounts.

By comparing and implementing these tax planning strategies, individuals can potentially reduce the amount of taxes they owe on their cryptocurrency investments and maximize their after-tax returns.

International Considerations for Crypto Taxation

Cryptocurrency taxation varies significantly from one country to another, with each jurisdiction having its own rules and regulations in place. Understanding how different countries treat cryptocurrency for tax purposes is crucial for individuals engaging in cross-border transactions involving digital assets.

Challenges of Dealing with International Tax Laws

- Complexity: Dealing with multiple sets of tax laws can be overwhelming and confusing, especially when they are constantly changing.

- Uncertainty: Lack of clarity on how to report and pay taxes on cryptocurrency transactions in different countries can create challenges for taxpayers.

- Compliance: Ensuring compliance with the tax laws of each country involved in a transaction adds an additional layer of complexity.

Examples of Tax Treaties Impacting Cross-Border Transactions

- The Double Taxation Avoidance Agreement (DTAA): This treaty helps taxpayers avoid being taxed on the same income in two different countries, providing relief from double taxation.

- Common Reporting Standard (CRS): The CRS is an information-sharing framework that allows tax authorities to automatically exchange financial account information, helping to prevent tax evasion.

- Transfer Pricing Rules: These rules govern the pricing of transactions between related entities in different countries, ensuring that transactions are conducted at arm’s length to prevent tax avoidance.

In conclusion, grasping the ins and outs of crypto tax obligations is crucial for anyone involved in cryptocurrency transactions. By staying informed and implementing proper tax planning strategies, individuals can navigate the complex world of crypto taxation with confidence.